|

|

|

|

ABEL GRIMMER - TOWER OF BABEL - PAGE 8

|

International Money

Fraud (IMF) |

The Dragon |

- The headquarters of the International Money Fund (IMF)

happens to be located in Washington DC.

- Very

conveniently, the World Bank is located right across the

street.

- What are these organizations and who controls

them, and most importantly, are they about to create another

huge worldwide depression.

- Of course, that is a question

that you can ask any year because it's been going on for over

a century.

|

The primary address for the International Monetary Fund (IMF) headquarters in Washington, D.C. is 700 19th Street, N.W., Washington, D.C. 20431, with visitor access often routed through the Visitor's Center at 720 19th Street, N.W. or the HQ2 building at 1900 Pennsylvania Ave NW. (Assistant)

|

Moat |

- If you step back in time to the aftermath of World War I

you can see that everyone was tired of war, so under the guise

of 'peacemaking,' the international bankers devised a plan to

consolidate power even further (into their hands).

- They

claimed that an international government (NWO) would stem the tide

of world wars, the money changers pushed forward a proposal

for world government which stood on 3 legs.

- Including, a

world private central bank of international settlements, a

world judiciary to be called the world court located in the

Hague, the Netherlands.

- And a world executive and

legislature to be called. the League of Nations.

World as they've

told us |

- As President Clinton's mentor, Georgetown University

historian Carrol Quigley wrote in his 1966 book, Tragedy

and Hope,

'The powers of financial capitalists had a far-reaching plan,

nothing less than to create a world system of financial

control in private hands.'

- A plan to dominate the

political system of each country, and the economy of the world

as a whole.

- This system was to be controlled, in a

feudalistic fashion, by the central banks of the world acting

in concert, by secret agreements arrived at in frequent

meetings and conferences.

World central bank |

- The apex of the system was to be the Bank of

International Settlements (BIS) located in Basel, Switzerland, a

private bank, owned and controlled by the world central banks

which were themselves, private corporations.

- Is that

pronounced as Bael, Switzerland?

- Each central bank sought

to dominate the government of its country by its ability to control treasury

loans, to manipulate foreign exchanges, in order to influence

the level of economic activity in the nation.

-

Additionally, to influence cooperative (corrupt) politicians

by subsequent economic rewards in the business world.

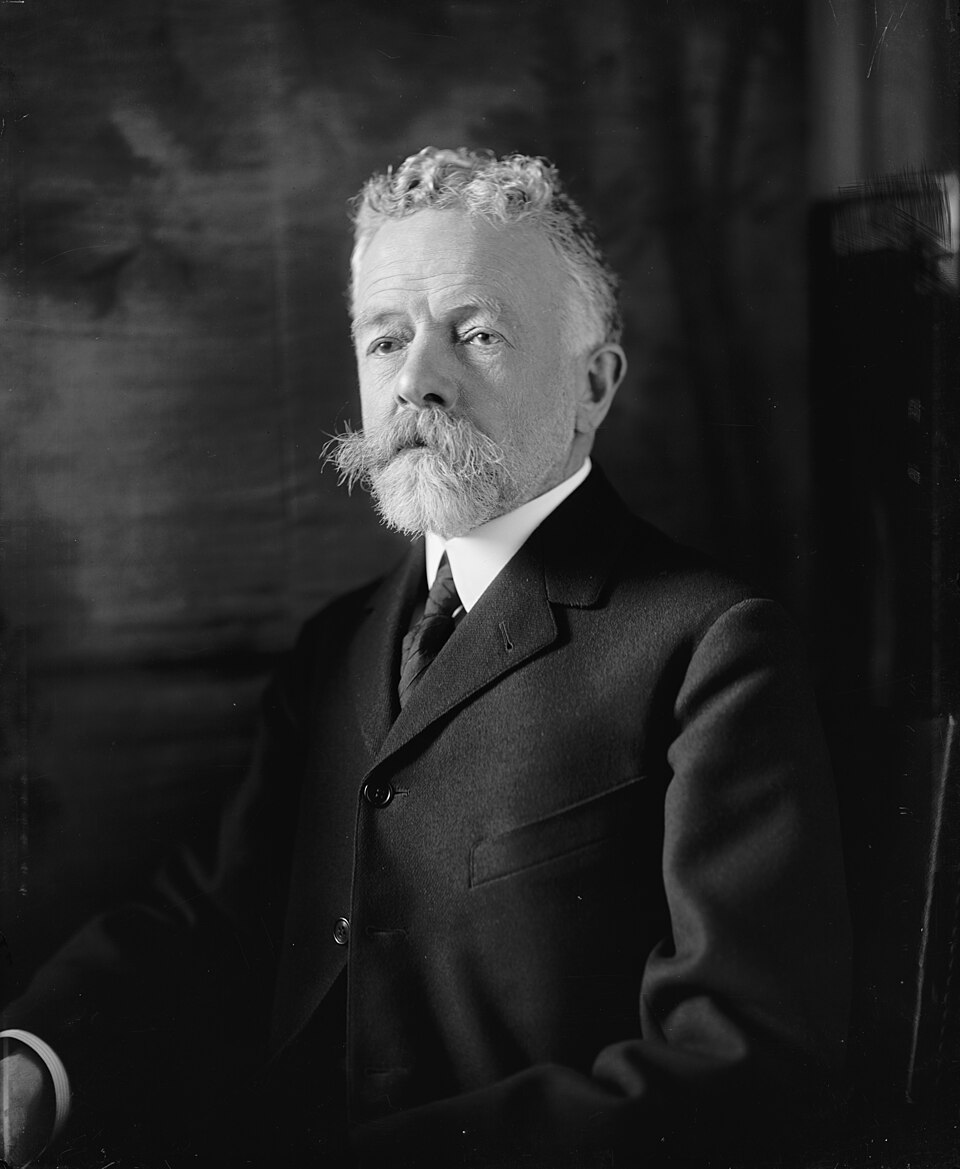

Harris & Ewing, photographer, Public domain, via Wikimedia Commons

Henry Cabot Lodge |

- Despite intense pressure from the international bankers

and the press, a handful of U.S. Senators led by Henry Cabot

Lodge (1850-1924), kept the U.S. out of these schemes.

- Without U.S.

participation, the League of Nations was doomed.

- But

wait, Henry Cabot Lodge was an American politician, historian, lawyer, and statesman from Massachusetts.

- He was a member of the Republican Party, he served in the United States Senate from 1893 to 1924 and is best known for his positions on foreign policy.

- His successful crusade against Woodrow Wilson's Treaty of Versailles ensured that the U.S. never joined the League of Nations and his penned conditions against that treaty, known collectively as the Lodge reservations, influenced the structure of the modern

United Nations!!!

|

Bill Clinton as Henry Cabot Lodge |

|

|

William Jefferson Clinton

1946

8/19

42nd president |

Henry Cabot Lodge

1850-1924

5/12

11/9

Senator |

|

|

|

Doesn't inhale |

|

|

|

|

|

More masonic hand

signs |

- Cabot Lodge may have sounded very noble, but it's called

talking out both sides of the mouth.

- United Nations,

really? Same thing as the League of Nations with a different

name.

Bank for

International

Settlements |

- Incredibly, even though the world rejected the world's

central bank, the BIS or Bank for International Settlements,

the Federal Reserve ignored the U.S. government and arrogantly sent

representatives to Switzerland to participate in the central

bankers meeting right up until 1944 when the U.S. was finally

officially dragged into it.

-

Their world government schemes thwarted, the bankers resorted

to their old formula, another war to wear down the resistance

to world government while reaping handsome profits.

|

During the 1995 Mexican Peso Crisis, President Bill Clinton authorized a massive U.S. financial rescue package,

bypassing Congress, which included significant contributions from the Bank for International Settlements (BIS) and the IMF; the BIS provided a $5 billion credit line to stabilize Mexico's currency, demonstrating international cooperation led by Clinton to prevent economic collapse, with Mexico eventually repaying its loans and the U.S. turning a profit. (Assistant)

|

Bolshevik

Revolution |

- To this end, Wall Street helped resurrect Germany

through the Thiessen banks which were affiliated with the

Harriman banks in New York.

- Just as Chase Bank assisted

in the financing of the Bolshevik Revolution during World War

I.

- Chase Bank was controlled by the Rockefeller family.

- Subsequently, it was merged with the Warburg's Manhattan

Bank to form the Chase Manhattan Bank.

- Since then, this

conglomerate has merged with Chemical Bank of New York, making

it the largest Wall Street bank.

- Their strategy worked,

even before World War II was over, world government was back

on track.

Bretton Woods |

- In July 1944, in Bretton Woods, New Hampshire, the

International Monetary Fund (IMF) and the World Bank were approved

with full U.S. participation.

- Notice these thieves always

meet at the finest hotels around the world, on your back.

-

The 2nd League of Nations, renamed the United Nations, was

approved in 1945.

- Soon a new international court system

was functioning as well.

- All effective opposition to

these international bodies before the war, had evaporated in

the heat of war, just as planned.

- These new organizations

simply repeated on a world scale what the National Banking

Act of 1864, and the Federal Reserve Act of

1913, had established in the U.S.

- Of course, Google AI

makes it all sound like a glorious heroic act.

|

Bretton Woods refers to the 1944 conference in New

Hampshire that established the post-WWII global

monetary system, creating the IMF (International

Monetary Fund) and World Bank (IBRD) to foster

stability, and also refers to the resort town in New

Hampshire famous for skiing and the historic Mount

Washington Hotel where the conference happened. The

system pegged currencies to the U.S. dollar, which was

convertible to gold, aiming to prevent economic chaos

through fixed exchange rates and cooperation. (Assistant)

|

The plan |

- They created a banking cartel, composed of the world's

central banks, which gradually assumed the power to dictate

credit policies to the banks of all the nations.

- For

example, just as the Federal Reserve Act authorized

the creation of a new national fiat currency called Federal

Reserve notes, the IMF has been given the authority to issue a

world fiate money called Special Drawing Rights or SDRs.

-

SDRs are allocated by the IMF to countries and central banks, and cannot be held or used by private parties.

- The number of SDRs in existence was around XDR 21.4 billion in August 2009.

- During the 2008 financial crisis, an additional XDR

182.6 billion was allocated to 'provide liquidity to the

global economic system and supplement member countries'

official reserves.

|

Special drawing rights (SDRs, code XDR) are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund (IMF).SDRs are units of account for the IMF, and not a currency per se.SDRs represent a claim to currency held by IMF member countries for which they may be exchanged. (Wikipedia)

|

Resources for more

war |

- The IMF’s current total resources of about SDR 982 billion translate into a capacity for lending of about SDR 695 billion (around US$932 billion), as of mid-December 2023.

-

Member nations have been pressured to make their currencies

fully exchangeable for SDRs.

- In 1968, Congress approved

laws authorizing the Federal Reserve (Fed) to accept SDRs as

reserves in the U.S., and to issue Federal Reserve notes in

exchange for SDRs.

- What does that mean? It means that in

the U.S., SDRs are already a part of our 'lawful' money.

|

The money the IMF loans to its members on its general – or non-concessional – terms comes from member countries, mainly through their payment of quotas. Multilateral and bilateral arrangements can supplement quota funds and play a critical role in the IMF’s support for member countries in times of crisis. (imf.org)

|

Governors meet at

posh places |

- And what about gold, well SDRs are already partially

backed by gold.

- With two-thirds of the world's gold

already in the hands of central banks, the money changers can

go about structuring the world's economic future in whichever

way they deem most profitable (for them).

- Keep in mind,

just as the Fed is controlled by its board of govenors, the

IMF is controlled by its board of govenors, which are either

the heads of the different central banks, or the heads of the

various national treasury departments, dominated by their

central banks.

- Voting power in the IMF gives the U.S. and

the U.K., that is to say the Fed and the Bank of England

effective control.

Profitable |

- Just as the Fed controls the amount of money in

circulation in the U.S., the BIS, IMF and World Bank, control

the money supply for the world.

- We see the repetition of

the old goldsmith's fraud, fractional reserve banking,

replicated on the national scale with central banks like the

Fed and on the international scale by the 3 arms of the world

central bank.

- Is this organization of the BIS, the IMF,

and the World Bank, which we refer to collectively as the

World Central Bank presently expanding and contracting world

credit?

- Yes, of course it is.

|

Fractional reserve banking is a system where banks keep only a fraction of customer deposits as cash reserves, lending out the rest, a process that expands the money supply as loans are deposited and re-lent, fueling economic growth but also posing risks like bank runs if too many depositors demand funds simultaneously. (Assistant)

|

Loan ratio |

- Regulations put into effect in 1988 by the BIS required

the world's bankers to raise their capital and reserves to 8%

of liabilities by 1992.

- Increased capital requirements

put an upper limit to the fractional reserve lending, similar

to the way cash reserve requirements do.

- What is this

seemingly insignificant regulation made in a Swiss city in

1988 meant to the world?

- It means that our banks cannot

loan more and more money to buy more and more time before the

next depression as a maximum loan ratio is now set.

- It

means that those nations with the lowest bank reserves in

their systems have already felt the terrible effects of this

credit contraction, as their banks scrambled to raise money to

increase their reserves to 8%.

Mexico financial

collapse |

- To raise the money, they had to sell stocks, which

depressed their stock markets and began the depression first

in their countries.

- Japan, which in 1988 had among the

lowest capital and reserve requirements, and thus was the most

affected by the regulation, experienced a financial crash

which happened almost immediately in 1989 and wiped out a

staggering 50% of its stock market since 1990 and 60% of the

value of its commercial real estate.

- The Bank of Japan

lowered its interest rates to one half of 1%, practically

giving away money to resurrect the economy, but still the

depression worsened due to the $20 billion U.S. bailout of

Mexico by President Bill Clinton.

- The financial collapse in that

nation was felt in the U.S., yet despite the bailout, the

Mexican economy continued to be a disaster.

Siphoned |

- One huge debt after another is rolled over as new loans

were made simply to enable Mexico to pay the interest on the

old loans.

- In the south of Mexico, the poor were in open

revolt as every spare peso was siphoned out of the country to

make interest payments.

- It is important to note that a

radical transfer of power is taking place as nations become

subservient to a supra-national world central bank, controlled

by a handful of greedy men.

- Also known as the world's

richest bankers (money changers).

Economic life and

death |

- As the IMF creates more and more SDRs by the stroke of a

pen on IMF ledgers, more and more of the nations borrow the

SDRs to make payments on interest on their mounting debts and

gradually fall under the control of the faceless bureaucrats

of the World Bank.

- As the worldwide depression

worsened and spread, this gave the World Bank the

power of economic life and death over these nations.

- It

will decide which nations will be permitted to receive further

loans, and which nations will starve.

- Despite all the

rhetoric about development and the alleviation of poverty, the

result is a steady transfer of wealth from the debtor nations

to the money changers central banks which control the IMF and

the World Bank.

Pay up |

- For example, in 1992, the 3rd-world debtor nations that

borrowed from the World Bank, paid $198 million more to the

central banks of the developed nations for World Bank funded

purposes than they received from the bank.

- All this

manipulation increases their permanent debt in exchange for

temporary relief of poverty caused by prior borrowings.

-

Very quickly, these repayments exceeded the amount of any new

loans.

- By 1992, Africa's external debt had reached $290

billion, or two and a half times greater than 1980, resulting

in skyrocketing infant mortality rates, unemployment rates,

deterioration of schools, housing and the general health of

the people.

- $290 billion in 1992 would have the purchasing power of roughly $669 billion to over $700 billion

by 2025.

Benefit of the

money changers |

- The entire world faced the immeasurable suffering that

destroyed the 3rd-world and Japan, all for the benefit of the

money changers.

- As one prominent Brazilian politician put

it, 'The 3rd World War has already started, it is a silent

war, not for that reason, any less sinister.'

- The war was

tearing down Brazil, Latin America and practically all the

3rd-world nations.

- Instead of soldiers dying, children died, and

it was over 3rd-world debt, and its main weapon, interest

payments.

- A weapon more deadly than the atom bomb, more

shattering than a laser beam.

Benefit of the

money changers |

- More recently, the subprime mortgage collapse in 2007

and how the crooks blamed it all on the unfortunate consumer

that borrowed for homes, only to have them stolen back by the

banks.

- All through the reign of George Bush Jr. and

Barrack Obama and with many racial overtones.

|

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010, contributing to the 2008 financial crisis. It led to a severe economic recession, with millions becoming unemployed and many businesses going bankrupt. The collapse of the 2000s United States housing bubble and high interest rates led to unprecedented numbers of borrowers missing mortgage repayments and becoming delinquent. This ultimately led to mass foreclosures and the devaluation of housing-related securities. (Assistant)

|

Deeply entrenched |

- Although it would be impossible to ignore the pivotal

role played by influential families such as the Rothschids,

the Warburgs, the Schiffs, the Morgans and the Rockefellers,

in any review of central banking and fractional reserve

banking, keep in mind by now central banks and the commercial

banks are over 3 centuries old.

- And unfortunately, deeply

entrenched in the economic life of many nations.

- These

banks are no longer dependent on clever individuals such as a

Nathan Rothschild.

- Years ago, the question of ownership

was important, but no longer.

- For example, both the Bank

of England and the Bank of France were nationalized after

World War II and nothing changed, nothing at all.

Hole in the rock |

- These corrupt central banks endure and continue to grow

now protected by numerous laws, paid-off politicians, and

mortgaged media, untouched by the changing of generations.

- Three centuries have given them a deceptive aura of

respectability.

- The old school tie is now worn by the 6th

generation son who's been raised in a system that he may never

question as he is named to serve on the governing boards of

countless philanthropic organizations.

- 'Philanthropy' is

usually nothing more than money changers stealing your wealth

and using it to fund their pet projects, not yours.

- To focus attention

today on individual families or to attempt to sort out the

current holder of power is futile and would be a distraction

from the cure.

Back door |

- The problem now is far bigger than even that, it's the

corrupt banking system these 'elites' built.

- Banking

systems that were and still are being used to consolidate vast

wealth into fewer and fewer hands.

- That is our current

economic problem.

- Change the name of the main players now

and the problem will neither go away nor even miss a beat.

- Although we do know that these shape shifters who rule us

are the same demons as before, they reincarnate into every

single generation.

Land sliding |

- Likewise, among the hordes of bureaucrats working in the

World Bank, central banks and the international bank, only a tiny

fraction have any idea what is going on.

- That is true for

many positions in banking, like the poor cashier, they have no

clue what is truly happening.

- Plus, they've been taught

through their schools and history books and Google AI that

it's all a great thing.

- No doubt they'd be horrified to

learn that their work is contributing to the terrible

impoverishment and gradual enslavement of mankind to a few

incredibly rich plutocrats.

Public domain, via Wikimedia Commons

Vice President Rockefeller (right) with Secretary of State Henry Kissinger on January 3, 1975

- (Big shots right?)

They're MOCKING you

with masonic hand

signals |

- Although, undoubtably, these plutocrats know damn

well what they'e doing.

- And unfortunately they're the

ones running things, generations and generations of them.

-

So really, there's no use emphasizing the role of individuals

anymore, instead, we need to remove their banking systems.

- Fire them, pure and simple.

- The problem even transcends the normal spectrum of political

right and left.

- Both communism and socialism, as well as

monopoly capitalism have all been used by the money changers.

Foreclosure |

- Today, they profit from either side of the new political

spectrum, the big government welfare state on the so-called

left wing, versus the neoconservative laissez faire

capitalists who want government totally out of their lives on

the right-wing.

- Either way, the bankers always seem to

win.

- Monetary reform is the most important political

issue facing this nation.

- That clarified, let's proceed

to the conclusions in the spirit Lincoln declared, 'With

malice towards none, with charity towards all.'

|

Laissez-faire capitalism is an economic system

promoting minimal government interference, believing

free markets driven by supply and demand, private

property, and self-interest lead to the best economic

outcomes, with the government's role limited to

protecting rights and enforcing contracts. Originating

in 18th-century France, its core idea is "let it be"

(laissez faire), letting individuals pursue their own

goals freely, though critics note it can create

inequality, monopolies, and issues with public goods.

(Assistant)

|

Quasi governmental |

- Some of the troubling questions, such as what's going on

in America now, why are we over our heads in debt?

- Why

can't the politicians bring debt under control?

- The

answer is, we're laboring under a debt money system that is

designed and controlled by private bankers.

- Some will

argue that the Federal Reserve system is a quasi governmental

agency, however, the president appoints only 2 of the 7

members of the Federal Reserve Board of Governors every 4

years.

- And he appoints them to 14-year terms, far longer

than his own.

- The Senate does approve those appointments

but the whole truth is that the president wouldn't appoint

anyone to that board of whom Wall Street does not approve!!!!

- They're all in the same masonic demonic boys club, just look

at all the hand signs they throw at you, curses and spells,

black magic.

Not usually very

honorable, just

imbred in the system |

- Of course this does not preclude the possibility that

some honorable men may be appointed to the board, but the fact

is that the Fed is specifically designed to operate

independently of our government, as are nearly all privately

owned central banks.

- As a result, you have the same

'elite' banking families lining up at the door to fill the

positions based on their 'knowledge' and recommendations from

family members.

- And the same thing is going on with our

political positions.

- The reason that it takes billions to

run for office now, we're all priced out of even

participating.

- No one even talks about growing up and

being a president now, only them, and they brazenly have their

'candidate' all lined up, long before the election begins

(which is another fraud).

|

So how much does a presidential campaign actually cost? Good Question.

"The first answer is a lot," David Schultz, a campaign finance expert and professor of political science at Hamline University, said.

Schultz estimates that between now and Election Day 2020, a candidate who makes it all the way will have to raise $500 million. That translates in about $1 million a day.

"They're spending a lot of time dialing for dollars," Schultz says. "This really filters out a lot candidates who are successful or unsuccessful." (cbsnews.com)

|

.jpg)

International Monetary Fund, Public domain, via Wikimedia Commons

Baron Edward George |

- Some argue that the Fed promotes monetary stability and

that is certainly not true, but many are brainwashed into

thinking that's true.

- However, we saw one head, Eddie

George, claim that this was the most important role of the

central bank.

- Edward Alan John George, Baron George (1938-

2009), known as Eddie George, or sometimes as 'Steady Eddie,'

was Governor of the Bank of England from 1993 to 2003 and, after his retirement, sat on the board of NM Rothschild and Sons.

- Why wouldn't he? He had lot's of 'experience' and a very

professional resume as well as lot's of connections and years

of experience in the racket.

|

Kissinger as Eddie George |

|

|

Henry A. Kissinger

1923-2023

5/23

5/29

Secretary of State |

Edward Alan John George

1938-2009

9/16

4/18

Banking Baron |

|

|

|

Bank of England |

-

|

Kissinger as Nelson Rockefeller |

|

|

Henry A. Kissinger

1923-2023

5/23

5/29

Secretary of State |

Nelson Aldrich "Rocky" Rockefeller

1908-1979

7/8

1/26

VP and NY governor |

|

|

|

The Aldrich Plan |

- Jeffrey Epstein used the Rockefeller name to gain social prominence and legitimacy, though he did not actually manage the Rockefeller family's wealth

(according to ever so trustworthy liars at Google AI).

- His connection was primarily with David Rockefeller, the former head of the family and a prominent figure in American finance and society.

|

Dershowitz as Eddie George |

|

|

Alan Morton Dershowitz

1938

9/1

U.S. Constitutional Law

no wonder it's broken |

Edward Alan John George

1938-2009

9/16

4/18

Banking Baron |

|

|

|

Steady Eddie

and Epstein Island |

-

Alan Dershowitz was part of the legal team that negotiated Jeffrey Epstein's controversial 2008 non-prosecution agreement with federal prosecutors in Florida.

- Bill Clinton, Donald Trump and Alan Dershowitz among the big names in Jeffrey Epstein’s birthday book.

- Dershowitz was a lawyer for Jeffrey Epstein and was accused by one victim, Virginia Giuffre, of sexual abuse on Epstein's private Caribbean island, among other locations.

- Dershowitz vehemently denied the allegations and sued Giuffre for defamation; Giuffre later dropped her lawsuit against him, stating she may have made a mistake in her identification.

- But poor Virginia is now dead, 'Yes, Virginia, there is a Santa

(Satan) Claus'.

- Steady alright.

Flushing |

- In fact, the Fed's record of stabilizing the economy

shows it to be a miserable failure in this regard.

- Within

the first 25 years of its existence, the Fed caused 3 major

economic downturns, including the Great Depression.

- From

1965 through 1995 they shepherded the American economy into a

period of unprecedented inflation which is even worse some 30

years later and it never ends.

- Again, this is not some

while conspiracy theory and it's a well-known fact among top

economists.

- Milton Friedman believed

that at least one-third of the price rise during and after

World War I was attributable to the establishment of the

Federal Reserve System and that the severity of each of the

major contractions was directly caused by acts of commission

and omission by the Reserve authorities.

|

The stock of money, prices and output was decidedly

more unstable after the establishment of the Federal

Reserve System than before. The most dramatic period

of instability in output was, of course, the period

between the two world wars, which includes the severe

money contractions of 1920-21, 1929-33, and 1937-38.

No other 20 year period in American history contains

as many as three such severe contractions. (Milton

Friedman)

|

Gold bricks |

- Friedman also felt that any system that gives so much

power and so much discretion to a few men, where mistakes,

excusable or not can have such far reaching effects, is a bad

system.

- It is a bad system to believers in freedom just

because it gives a few men such power without any effective

check by the body politic, reveals that this is a key

political argument against an independent privately owned

central bank.

- To paraphrase Clemenceau, 'money is much

too serious a matter to be left to the central bankers.'

-

We must learn from our history before it is too late.

Debt creation |

- Why can't politicians control our federal debt? Because

all of our money is created out of debt.

- That's because

it's a debt money system.

- Our money is created initially

by the purchase of U.S. bonds.

- The public buys Savings

Bonds, the banks buy bonds, foreigners buy bonds, and when the

Fed wants to create more money in the system, they purchase

U.S. bonds.

- However, they pay for them with a simple bookkeeping entry

which it creates out of nothing, thin air.

- Then, this new

money created by the Fed is multipled by a factor of 10 by the

banks, thanks to the fractional reserve principle.

Inflation caused by

banks |

- Although the banks don't actually create currency,

that's the job of the U.S. Mint, they do create checkbook

money or deposits by making new loans.

- They even invest

some of this created money, in fact, by 1995, over $1 trillion

of this privately created money has been used to purchase U.S.

bonds on the open market which provides the banks with roughly

$50 billion in interest, risk-free, each year, less the

interest they pay to some depositors.

- In this way,

through fractional reserve lending, banks create over 90% of

the money and therefore cause over 90% of our inflation.

Serious financial

problems |

- What can we do about all this?

- Fortunately there's

a way to fix the problem fairly easily, quickly, and without

any serious financial problems.

- We can get our country

totally out of debt in 1-2 years by simply paying off these

U.S. bonds with debt-free U.S. notes, just as Lincoln issued

the Greenbacks during the Civil War.

- Of course, that by

itself would create tremendous inflation since our currency is

currently multipled by the fractional reserve banking system.

- This is because for every $1 we save, they loan out $10, and

likewise, for every $1 we pay off, they reduce the money in

circulation by $10.

Currently unstable |

- But here's the ingenious solution advanced in part by

economist Milton Friedman, to keep the money supply stable and

avoid inflation and deflation while the debt is retired.

-

As the U.S. Treasury buys up its bonds on the open market with

U.S. notes (created by our government, not by privately owned

bankers), the reserve requirements of your hometown bank will

be proportionally raised.

- So therefore, the amount of

money in circulation remains constant.

- As those holding

U.S. bonds are paid off in U.S. notes, they will deposit this

money, thus making available the currency then required by the

banks to increase their reserves.

Fed buildings |

- Once all the U.S. bonds are replaced with U.S. notes,

banks will be at 100% reserve banking, instead of the

fractional reserve system currently in use.

- Of course

this also entails getting rid of the Federal Reserve and not

participating in IMF international banker schemes.

- From

this point on, the former Fed buildings will only be needed as

a central clearing house for checks and as vaults for U.S.

notes.

- The Federal Reserve Act will no longer be

necessary and should be repealed.

- Monetary power can be

transferred back to the U.S. Treasury department.

- There

would be no further creation, or contraction of money by

banks.

Horizon |

- By doing it this way, our national debt can be paid off

very quickly, and the Fed and fractional reserve banking

abolished without national bankruptcy, financial collapse,

inflation, or deflation, or any significant change in the way

the average American goes about their business.

- To the

average person, the primary difference would be that for the

first time since the Federal Reserve Act was passed

in 1913, taxes would begin to go down.

- Now there's a real

national blessing for you, rather than for Alexander

Hamilton's banker friends in Britain.

Provisions in

detail |

- Now let's take a look at these proposals in more detail,

here are the main provisions of a monetary reform act which

needs to be passed by Congress.

-

The

Money Masters and journalist William T. Still have drafted a proposed

monetary reform and of course variations would be equally

welcome.

- It's a simple, 4-step process.

1) Pay off the U.S.

debt |

- Pay off the debt with debt-free U.S. Notes, as Thomas

Edison framed it, 'if the U.S. can issue a dollar bond, it can

issue a dollar note (bill).'

- They both rest purely on the

faith and credit of the U.S. government which seems to have

been greatly reduced in recent years because of all this money

manipulation the Fed has inflicted.

- This requires a

simple substitution of one type of government obligation for

another; one bears interest, the other doesn't.

- Federal

Reserve notes could be used as well, but could not be printed

after the Fed is abolished.

2) No more

fractional reserve

banking |

- The main problem; abolish fractional reserve banking.

- As the debt is paid off, the reserve requirements of al

banks and financial institutions would be raised

proportionally at the same time to absorb the new U.S. notes

which would be deposited and become the banks' increased

reserves.

- Towards the end of the first year of the

transition period, the remaining liabilities of financial

institutions would be assumed or acquired by the U.S.

government in a one-time operation.

- In other words, they

too would eventually be paid off with debt-free U.S. notes in

order to keep the total money supply stable.

- By the end

of the first year or so, all of the national debt would be

paid and we could start enjoying the benefits of full reserve

banking.

- Thankfully, the Fed would be finally obsolete,

an anachronism, over and done.

3) Repeal of the

Federal Reserve Act |

- Repeal of the Federal Reserve Act and the

National Banking Act of 1864 in Congress.

- These acts

delegated the money and financial power of our nation to a

private banking cartel.

- They must be repealed and the

money power handed back to our U.S. Treasury where they were

initially under President Abraham Lincoln, although he later

made the mistake of allowing a private bank to take control

through the National Banking Act.

- No banker or

person in any way affiliated with financial institutions

should be allowed to regulate banking, think about how crazy

that is (like putting your child in charge of their report

card).

- After the first 2 reforms, these Congressional

acts would serve no useful purpose since they relate to a

fractional reserve banking system.

4) Withdraw the

U.S. from the IMF

and World Bank |

- Withdraw the U.S. from the IMF, the BIS and the World

Bank because these institutions, like the Federal Reserve are

designed to further centralize the power of the international

bankers over the world's economy and we must withdraw from

this scam.

- Their harmless functions such as currency

exchange can be accomplished either nationally, or in new

organizations limited to those functions.

- Such a monetary

reform act would guarantee that the amount of money in

circulation would stay very stable, causing neither inflation

nor deflation.

- Remember, for the last several decades, the Fed has

managed to double the American money supply every 10 years.

- That, along with fractional reserve banking are the real

causes of inflation and the huge reduction in our buying

power, a hidden tax.

The swamp |

- These, and other taxes are the real

reason that both parents now have to work, just to get by.

- The money supply should increase slowly, to keep prices

stable, roughly in proportion to population growth about 3% a

year, not at the whim of a bunch of greedy bankers meeting in

secret.

- In fact, all future decisions on how much money

should be circulating in the economy must be made based on

statistics of population growth and the price level index.

- The new monetary regulators and the U.S. Treasury would have

absolutely no discretion in this matter except in time of

declared war, although those should reduce significantly if we

didn't have money changers provoking them.

|

A Price Level Index (PLI) measures the relative cost of goods and services across countries or regions, showing how expensive one place is compared to another, often using the world or a specific group (like the EU) as a baseline of 100. It's calculated by comparing a country's Purchasing Power Parity (PPP) to its market exchange rate; a PLI over 100 means prices are higher than the average, while below 100 means they're cheaper, helping assess living costs and pricing strategies. (Assistant)

|

Public, not secret |

- This would ensure a steady, stable money growth of

roughly 3% per year, resulting in stable prices and no sharp

fluctuation in the money supply.

- To make certain the

process is completely open and honest, all deliberations would

be public, not secret, as meetings of the Fed's board of

governors are today.

- How do we know this will work?

-

Because these steps remove the 2 major causes of economic

instability, the Fed and fractional reserve banking, and the

newest one as well, the BIS, Bank of International

Settlements.

- But most importantly, the danger of a severe

depression would be eliminated.

|

I know of no severe depression, in any country, at

any time, that was not accompanied by a sharp decline

in the stock of money, and equally of no sharp decline

in the stock of money that was not accompanied by a

severe depression. (Milton

Friedman)

|

Island in the

English Channel |

- Issuing our own currency is not a radical solution, it's

been advocated by Presidents Jefferson, Madison, Jackson and

VanBuren and Lincoln.

- But it's been used at different

times throughout Europe as well, perhaps the best examples is

one of the small islands off the coast of France in the

English Channel, called Guernsey.

- This small country has

been using debt-free money issues to pay for large building

projects for over 200 years.

- In 1815, a committee was

appointed to investigate how to finance the Guernsey vegetable

market.

Island was

impoverished |

- The impoverished island could not afford more new taxes.

- So the leaders decided to try a revolutionary

idea, issue their own paper money.

- They were simply

colorful paper notes, backed by nothing but the people agreed

to accept them and trade with them.

- To ensure they

circulated widely, they were declared to be 'good for the

payment of taxes.'

- Of course this idea was nothing new,

it was exactly what America had done before the American

Revolution, and there are many other examples throughout the

world.

- But it was new to Guernsey, and it worked

miracles, in fact, the original vegetable market is still in

use and it was built without creating any debt to the people of this island

state.

- And remember, the currency is actually backed by

the hard-work and human labor of the nation, and then

circulated to buy goods in exchange for their hard work.

Authorization |

- What if we followed Guernsey's example, how would these

greedy bankers react to these reforms?

- Certainly the

international bankers will oppose reforms that do away with

their control of the world's economies as they have in the

past.

- But it is equally certain that Congress has the

constitutional authority and the responsibility to authorize

the issuance of debt-free money, U.S. notes, and to reform the

banking system and laws it ill-advisedly enacted.

- Because

you have to wonder about everything these Congressional seat

holders and our politicians have done every step of the way.

Stone masons |

- Things like forgetting to make any provisions for our

money handling and currency when they wrote this

Constitution and then suddenly it rears it's ugly head as

an afterthought?

- Or was this all intentional because

we've had a lot of corrupt people with their hands in things,

such as Alexander Hamilton, our 'Founding Father,' right.

-

Of course our history books claim it was all good, but it sure

wasn't from the very start, including why we even needed this

Constitution.

- We already had Articles of

Confederation but the money changers needed stronger

wording in order to create wars and entrap us in their debt

and tax us to pay for it all (and their lavish 'elite'

lifestyles).

Builder burg |

- What we really needed was checks and balances on our

Founding Fathers and our leaders.

- Even the hypocrisy of

it all, like political parties claiming one thing and then

doing the complete opposite after they're elected.

- Plus all the cronyism and nepotism,

we've had plenty, and all the masonic hand signs they all flash around, a corrupt good old boys club.

- Also the

effects of all these 'lawyers' bending things around and

undermining the original intent, to suit themselves!

Working with stone |

- Undoubtedly the bankers will claim that issuing

debt-free money will cause severe inflation or make other dire

predictions.

- But remember, it is fractional reserve

banking and the Fed which is the real cause of over 90% of all

inflation, not whether debt-free notes are used to pay for

government deficits.

- In the current system, any spending

excesses on the part of Congress are turned into more debt

bonds and the 10% purchased by the Fed are then multiplied

many times over by the bankers, causing over 90% of all

inflation.

- Our fractional reserve and debt-based banking

system is the problem.

- We must ignore its inevitable

resistance to reform, especially from the good old boys club

who run everything.

- And remain firm until the cure is

complete.

Happier world |

- As the director of the Bank of England in the 1920s, Sir

Josiah Stamp (1880-1941) put it this way, referring to this 'modern'

fractional banking, 'Banking is conceived in inequity and born

in sin, bankers own the earth, take it away from them.'

-

Stamp knew that by leaving the power to create money and

control credit with the

bankers, with the 'flick of a pen' they

will create enough money to buy it back again.

- But if you

want to continue as the slaves of bankers and pay the cost of

our own slavery, let them continue to create money and control

credit.

|

Take this great power away from the bankers and all great fortunes like mine will disappear, and they ought to disappear, for this would be a better and happier world to live in. (Sir

Josiah Stamp)

|

Figuring things out |

- Americans are slowly figuring this out and today over

3,200 cities and counties have endorsed the proposal of a

non-profit agency called Sovereignty.

- The Sovereignty

Movement calls for Congress to authorize the Secretary of the

Treasury to issue $90 billion per year of U.S. notes, not

Federal Reserve notes or debt-based bonds, to loan money

interest free to cities, counties and school districts for

needed capital improvements.

- Remarkably, and to their

praise, the Community Bankers Association of Illinois,

representing 515 member banks, endorsed this Sovereignty

proposal.

- Of course if you listen to the crooks and

Google AI as follows, they disapprove and turned Republican

candidate Ron Paul and his supporters into anarchists because

he proposed ending the Fed and auditing the Fed, something

that was mandated by Congress since the beginning, but never

accomplished, how sleazy.

|

The Sovereign Citizen Movement is a loose collection of anti-government extremists and conspiracy theorists, primarily in English-speaking common law countries, who believe they are exempt from government authority and laws. Adherents operate outside the legal system, often engaging in illegal and fraudulent activities, including "paper terrorism" against officials. The FBI classifies some sovereign citizens as domestic terrorists. (Assistant)

|

Contraction of

money |

- As Milton Friedman has repeatedly pointed out, no severe

depression can occur without a severe contraction of money.

- In our corrupt system, only the Fed, the Bank of

International Settlements, with U.S. bankers cooperation, or a

combination of the largest Wall Street banks could cause a

depression.

- In other words, our economy is so huge and

resilient, a depression just can't happen by accident.

-

And that is especially true because of our great regional

diversity with different areas and sectors in the nation

producing different goods, it would be virtually impossible to

create a national depression.

- Unless we reform our

banking system, these crooks will always have that power over

us.

- They can pull the plug on our economy any time they

choose, which they have done often.

Elite towers |

- The only solution is to abolish the Fed and the

fractional banking system and withdraw from the BIS.

- Only

that will break the power of the international bankers over

our economy.

- Keep in mind, a stock market crash itself

cannot cause a severe depression.

- Only the severe

contraction of our money supply can cause a severe depression.

- The stock market crash of 1929 only wiped out market

speculators, mostly the small to medium ones, resulting in $3

billion in wealth changing hands.

- But it served as a

smokescreen for a 33% contraction in credit by the Fed for

next 4 years which resulted in over $40 billion in wealth from

the American middle class being transferred to the big banks.

Depressing |

- Then, despite impotent howls of protest from a divided

Congress, the independent Fed kept the money supply contracted

for a full decade!!!

- Only World War II ended the terrible

suffering the Fed purposely inflicted on the American people

for their own gain.

- In a depression, the remaining wealth

of the debt burdened American middle class will be wiped out

by unemployment, declining wages and the resulting

foreclosures.

- If we start to act to reform our monetary

system, the Feds may do what they did in 1929 into the 1930s, crash the

stock market, where so much American wealth is held, and use

that as a smokescreen while contracting the money supply.

Cliff edge |

- However, if we're determined to regain control over our

money, we can come out of it fairly quickly, perhaps in only a

very few months as U.S. notes begin to circulate and replace

the money withdrawn by the demonic bankers.

- The longer we

wait, the greater the danger we'll permanently lose control of

our nation.

- Some still wonder why the international

bankers would want to cause a depression.

- Wouldn't that

be killing the goose that is currently laying all those golden

interest eggs?

- Remember what Larry Bates said, 'Periods

of economic upheaval, in economic crisis, wealth is not

destroyed, it is merely transferred.'

Banker man-made

crisis |

- Do we have any hints as to what the money changers have

in store for us?

- Here's what David Rockefeller, the

chairman of Chase Manhattan Bank, the largest Wall Street bank

had to say.

- 'We are on the verge of a global

transformation, all we need is the right major crisis and the

nation will accept the New World Order.'

- So, crisis is

needed to fulfill their plans quickly, the only question is

when the crisis will occur.

- But whether or not they

decide to cause a crash or depression, through relentless

increases in taxes and the loss of hundreds of thousands of

jobs sent overseas, thanks to trade agreements like GATT and

NAFTA, and newly created threats like AI, the American middle

class is an endangered species.

Cheaper labor (for

now) |

- Cheaper labor, including slave labor in places like red

China, is being used to compete with American labor.

- As a

result, money is being consolidated in fewer and fewer hands

as never before in the history of this nation or the world.

- Without reform, the American middle class will soon be

extinct, leaving only the very rich few, and the very many

poor, as has already occurred throughout most of the world.

- We've been warned about all of this by some congressmen, and

even fewer presidents, industrialists and economists down

through the years.

Education instead

of their 'elite'

brainwashing |

- Educate your friends because our

country needs a solid group who really understand how our

money is manipulated and what the solutions really are,

because if a depression comes, there will be those who call

themselves conservatives who will come forward advancing

solutions framed by the international bankers.

- Beware of

calls to return to a gold standard because never before has so

much gold been so concentrate outside of American hands.

-

And never before has so much gold been in the hands of

international governmental bodies such as the World Bank and

International Monetary Fund (IMF).

- A gold backed currency

usually brings despair to a nation and to return to it would

certainly be a false solution, on top of the fact there is

simply not enough gold to back up our currency.

Men at work |

-

Remember, we had a gold backed currency in 1929 and during the

first 4 years of the Great Depression.

- Likewise, be aware

of any plans for a regional or world currency because this is

the international bankers Trojan Horse.

- Educate your

member of Congress because it only takes a few persuasive

members to make the others pay attention.

- Most

congressmen just don't understand the system, some do

understand it, but are so influenced by bank padded

contributions that they ignore it.

- Learn more at

themoneymasters.com with William T. Still.

|

Thy ambition,

Thou scarlet sin, robb'd this bewailing land.

Shakespeare,

Henry VIII

| |

|

|