|

|

ABEL GRIMMER - TOWER OF BABEL - PAGE 5

|

Rothschild - How

International

Bankers Gained

Control |

Master masons |

- You have to ask what's going on in America today and why

are we over our heads in debt?

- Why can't any of these

politicians we've elected bring debt under control?

- Why

are so many people, often both parents, working at lowpaying

deadend jobs and yet still having to make do with less and

less while the 'elites' have more and more?

- You have to wonder what will happen to the economy

and American way of life.

- Why does government continue to

tell us that inflation is low when the buying power of our

paychecks is declining at an alarming rate?

Government debt |

- The problem is that since 1864, we've had a debt-based

banking system.

- All of our money is based on government

debt.

- Unfortunately, we can't extinquish this debt

without extinquishing our money supply.

- That's why

talking about paying off the national debt without reforming

our banking system is an impossibility.

- This means that

the solution does not lie in discussing the size of the

national debt.

- Rather, it lies in reforming our banking

system.

Bank vault |

- The headquarters for the Federal Reserve resides in

Washington DC.

- It has an impressive address on

Constitution Avenue, right across from the Lincoln Memorial.

- But it has nothing to do with 'federal' because it's a

private corporation, not part of our federal government and it

has no 'reserves.'

- The name is a deception and was

created before the Federal Reserve Act was passed in

1913.

- This was to make American's think that our central

bank operates in the public interest.

Private |

- The truth is that the Federal Reserve is private

bank owned by private stockholders and run purely for their

private profit.

- This bank has no actual reserves, at

least no reserves available to back up the Federal Reserve

notes which is our common currency.

- That is to say it had

doubtful reserves and is a private bank that is owned by

member banks and it was chartered under the guise of deceit by

an act of Congress.

- If there is still any doubt that the

Federal Reserve is part of government, check your local

telephone book and you will notice it is not listed in the

blue government pages.

- Instead, it is listed in the

business white pages, right next to Federal Express, another

private company.

Independent bank |

- But more directly, U.S. courts have ruled time and time

again that the Federal Reserve is a private corporation.

-

So why can't Congress do something about the Federal Reserve?

- Most members of Congress don't understand the system, or

they profit from it.

- The few who do understand are afraid

to speak up.

- However, there are some who have spoken up,

one was Republican representative Charles A. Lindbergh from Minnesota in

1923.

- Lindbergh knew that the Federal Reserve Board

administers the finance system by authority of a purely

profiteering group.

|

Congressman Charles A. Lindbergh Sr. ( father of the famous aviator) was a fierce critic of the Federal Reserve Act of 1913, calling it the "most gigantic trust on earth," a legalized "invisible government," and a system that would allow a "money trust" to control the nation's finance for profit, creating panics and burdening citizens through private control of credit, according to his book Lindbergh on the Federal Reserve.

(Assistant)

|

Bank profiteers |

- The system is private, conducted for the sole purpose of

obtaining the greatest possible profits from the use of other

people's money (ours).

- One of the most outspoken critics of the

Federal Reserve, also know as the 'Fed,' was the former

chairman of the House Banking Currency Committee during the

Great Depression.

- This was Lewis T. McFadden, Republican

from Pennsylvania, who said in 1932 that the Fed was one of

the most corrupt institutions the world has ever known.

-

He called it an evil institution that has impoverished the

people of the United States and has practically bankrupted our

government.

- And that the Fed had accomplished this

through the corrupt practices of the moneyed vultures who

control it.

More dangerous |

- Republic Senator Barry Goldwater from Arizona was a

frequent critic of the Fed and he made it known that most

Americans have no real understanding of the operation of the

international moneylenders.

- The accounts of the Federal

Reserve System have to this day, never been audited.

- It

operates outside the control of Congress and manipulates the

credit of the United States.

- Even though the Federal

Reserve is not part of the government, it is more powerful

than the Federal government.

- More powerful than the

president, the Congress and the courts.

Controls your house

payment |

- Many people challenge this, but what the Federal Reserve

does is estimate what the average person's automobile payment

is going to be, what their house payment is going to be, and

whether they have a job or not.

- Whether you believe it or

not, that is total control, the borrower is servant to the

lender.

- The Federal Reserve is the largest single

creditor of the U.S. government.

- What one has to

understand is that from the day the U.S. Constitution was

adopted, right up to current day, the individuals who profit

from privately owned central banks, the money changers, have

fought a running battle for control over who gets to print

American money.

Profit |

- Why is who prints the money so important?

- Think of

money as just another commodity, and realize that if you have

a monopoly on a commodity that everyone needs, everyone wants,

and nobody has enough of, there are lot's of ways to make a

profit.

- At the same time, it can be used by these

racketeers to exert tremendous political influence.

-

That's what this battle is all about because throughout the

history of the U.S., the money power has gone back and forth

between Congress and some sort of privately owned central

bank.

Moving our money |

- The Founding Fathers knew the evils of a privately owned

central bank.

- First of all, they had witnessed how

Britain's privately owned central bank, the Bank of England,

had run up the British national debt to such an extent that

Parliament had been forced to place unfair taxes on the

American colonies.

- In fact, Benjamin Frankin claimed that

this was the real cause of the American Revolution.

- Most

of the Founding Fathers realized the potential dangers of

banking and feared the bankers accumulation of wealth and

power.

|

Thomas Jefferson famously stated, "I believe that banking institutions are more dangerous to our liberties than standing armies," reflecting his deep suspicion of centralized financial power and debt, seeing private banks as threats to republicanism and the people's property, especially compared to the visible threat of a military force. He believed private banks could corrupt the government, control currency, and create perpetual debt, ultimately enslaving future generations, a concern he voiced in letters, particularly to John Taylor, and in opposition to the National Bank.

(Assistant)

|

Return to rightful

owners |

- Thomas Jefferson believed that the issuing power should

be taken from the banks and restored to the people to whom it

belonged.

- This succinct statement of Jefferson is in fact

the solution to all our economic problems today.

- James

Madison, the main author of the Constitution called those

behind the central bank scheme money changers and he strongly

criticized their actions.

- The battle over who gets to

control our money has been the pivotal issue throughout the

history of the U.S.

- Wars are fought over it, depressions

are caused in order for the profiteers to acquire it.

|

History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money and its issuance.

(James Madison)

|

Wars are fought for

profit |

- Yet, after World War I, this battle over the issuing

power of the Federal Reserve was rarely mentioned in

newspapers or history books.

- How did this happen, by

World War I, the money changers with their dominant wealth had

also seized control of most of the nation's media and press.

- Throughout U.S. history, this battle over who gets the power

to issure our money has raged.

- In fact, it's changed

hands, back and forth 8 times since 1764.

- Although this

history has virtually vanished from public view for over 3

generations behind a smokescreen emitted by Fed cheerleaders

in the media.

|

Former Republican representative

Ron Paul famously views the Federal Reserve as detrimental, calling it the "biggest taxer of them all" for devaluing the dollar through money printing, causing artificial booms and busts, and undermining sound money principles, advocating its abolition

(End the Fed) for true capitalism and liberty. He believes the Fed creates economic crises, saying every major downturn traces back to its policies of easy credit and central planning, which ultimately harm the middle class.

(James Madison)

|

Hiding behind

deception |

- In fact, you might say that outspoken critics like Ron

Paul were laughed out of Congress.

- Until we finally stop

talking about deficits and government spending, and start

talking about who controls how much money we have, it's all

just a big shell game.

- A complete and utter deception

because it won't matter if you pass an ironclad amendment to

the Constitution mandating a balanced budget.

- Our

situation is only going to get worse until we root out the

cause and its source.

Theft and deception |

- What's the solution for our national problem?

- First

of all, we need to educate everyone, but secondly, we must

act, we must take back the power to issue our own money.

-

Issuing our own money is not a radical solution.

- It's the

same solution used at different points in U.S. history by our

leaders.

- To sum it up, in 1913, Congress gave an

independent central bank, deceptively named the Federal

Reserve, an undeserved monopoly over the issuence of American

money.

- The debt generated by this quasi private

corporation is what is killing the American economy.

Hazy |

- Though the Federal Reserve is now the most powerful

central bank in the world, it was not the first.

- So where

did this idea come from?

- To really understand the

magnitude of the problem, we have to travel back to Europe.

- So who exactly are these money changers that our Founding

Fathers spoke about?

- As corrupt and 'retranslated' as the Bible is, the only

time 'money changers' were mentioned was when the Jews came to

the temple in Jerusalem to pay their temple taxes.

- They

could only pay it with a special coin, the half shekel of the

sanctuary which was a half ounce of pure silver about the size

of a U.S. dime.

Shekel's required |

- The shekel was the only coin during that time that was

the pure silver assured weight without the image of the

'pagan' emperor such as Julius Caesar.

- Therefore, to Jews, the

half shekel was the only coin acceptable to their God.

- But

these coins were not plentiful, the Jewish money changers had

cornered the market on them.

- Then they raised the price,

just like every other commodity to whatever the market would

bear.

- In other words, money changers were making

exorbitant profits and taxpayers would have to exchange their

assets at the local temple for one of their shekel's because

it was the only currency the money changers would accept.

-

They held a virtual monopoly on money and the Jewish taxpayers

were obligated to pay whatever they demanded.

Back door |

- However, this money changing scam did not originate in

Jerusalem 2,000 years ago, because 200 years prior to that,

Rome was also having trouble with money changers.

- In

fact, two early Roman emperors had tried to diminish the power

of the money changers by reforming usary laws and limiting

land ownership to 500 acres.

- They were both assassinated

and in 48 BC, Julius Caesar took back the power to coin money

from the money changers and minted coins for the benefit of

all.

- With this new plentiful supply of money, Caesar

built great public works projects and by making money

plentiful, he won the love of the common man, but the money

changers hated him.

Caesar's

assassination |

- Some believe that this was an important factor in

Caesar's assassination.

- One thing is for sure, with the

death of Julius Caesar, came the demise of plentiful money in

Rome, and taxes increased as did corruption.

- Just as in

the case of in America today, usery and debased coin became

the rule.

- Eventually, the Roman money supply was reduced

by 90% and as a result, the common people lost their land and

their homes.

- Just as what is happening in America with

the demise of plentiful money, the masses lost confidence in

the Roman government and refused to support it.

- They

stopped paying taxes and Rome plunged into the gloom of the

dark ages.

Directs the money

supply |

- A thousand years later, the money changers, those who

loan out and manipulate the quantity (and quality) of money

were active in medieval England.

- In fact, by acting

together, they could manipulate the entire English economy.

- These were not bankers per se, because the money changers

were typically the goldsmiths.

- They were the first

bankers because they started keeping other people's gold for

safekeeping in their vaults.

- Much the same way the

original Knights Templar would store the gold of pilgrims

visiting Jerusalem and protecting them along the way, they

owned the 'bank' and

became terribly corrupt.

- The first paper money was

merely a receipt for the gold left with the goldsmith.

Demanding their

gold |

- Paper money caught on because it was more convenient

than carrying around a lot of heavy gold and silver coins and

the risk of theft decreased.

- Eventually, these crafty

goldsmiths noticed that only a small fraction of depositors

ever came into their shops and demanded their gold at any one

time.

- Greedy goldsmith's started cheating on the system

and they quickly discovered that they could print more paper

money than they had gold and usually, no one would be the

wiser.

- Next they discovered that they could lend out this

money and collect interest on it.

Fractional reserve

banking |

- This was the birth of fractional reserve banking which

means you are loaning out many times more money than you have

assets on deposit.

- So if $1,000 worth of gold were

deposited with them, they could loan out about $10,000 in

paper money and draw interest payments on it and no one would

ever discover the deception.

- Through this means,

goldsmiths gradually accumulated more and more wealth and used

this wealth to acquire more and more gold.

- Today, this

practice of loaning out more money than there are reserves is

known as fractional reserve banking.

Rush |

- Every bank in the

U.S. is now allowed to lend out at least 10 times more money

than they actually have.

- That's why they get rich on

charging, let's say 8% interest, it's not really 8% per year

which is their income, it's 80% and that's why bank buildings

are always the largest in town.

- And when they talk about

a 'rush' on the bank this happens when people lose trust and

all run to the bank and demand their money at the same time,

which the bank does not have, they only have 10% of it at any

one time.

Forbade interest on

loans |

- But that does not mean that all banking, or all interest

should be illegal.

- In the middle ages, Canon law, the law

of the Catholic Church, forbade charging interest on loans.

- This concept followed the teachings of Greek Aristotle and

St. Thomas Aquinas who taught that the purpose of money was to

serve the members of society.

- In order to facilitate the

exchange of goods needed to lead a virtuous life.

-

Interest in their belief, hindered this purpose by putting an

unecessary burden on the use of money.

- In other words,

interest was contrary to reason and justice.

Crime |

- Reflecting the same beliefs in the Middle Ages, Europe

forbade charging interest on loans and made it a crime called

usery.

- As commerce grew, and therefore opportunities for

investment arose in the late Middle Ages, it came to be

recognized that to loan money there was a cost involved to

loan that money.

- The casheir needed a paycheck and it was

a full-time job.

- For the lender, it was both risk and

lost opportunity and so some charges or fees were allowed, but

not interest per se.

- However, all moralists, no matter

what religion, condemned fraud, oppression of the poor, and

injustice as clearly immoral.

- As we will see, fractional

reserve lending is routed in a fraud, results in widespread

poverty, and reduces the value of everyone else's money.

-

The ancient goldsmiths discovered that extra profits could be

made by controlling the money through easy money versus tight

money.

Expanding business |

- When they made money easier to borrow, then the amount

of money in circulation expanded and money was plentiful.

-

People took out more loans to expand their businesses,

however, then the money changers would tighten the supply.

- They would make loans more difficult to obtain and what

happened next is the same thing that still happens today.

-

A certain percentage of borrowers could not repay their

previous loans and could not take out new loans to repay the

old loans.

- Therefore, they went bankrupt and had to sell

their assets to the goldsmiths for pennies on the dollar.

-

The same thing is still going on today, only today we call

this 'rowing' of the economy, up and down the business cycle.

Money power |

- Like Julius Caesar, in England, King Henry I finally

resolved to take the money power away from the goldsmiths

about 1100 AD.

- Henry I could have used anything as money,

seashells (Caligula), feathers, or even Yak dung, as is often done in

remote Tibetan provinces, but he invented one of the most

unusual money systems in history.

- It was called the

tally stick system, and this form of British money lasted 726

years, until 1826.

- A tally stick was adopted to avoid the

monetary manipulation of the goldsmiths and the sticks were

money fabricated out of sticks of polished wood.

Tally stick |

- Notches were cut along one edge of the stick to indicate

the denominations.

- Then the stick was split lengthwise

through the notches so that both pieces still contained a record of the

notches.

- The king kept one half, to protect against

counterfeiting, then he would spend the other half into the

economy and they would circulate his money.

- A tally stick

was often so large it could represent £25,000.

- One of the

original stockholders in the Bank of England, purchased his

shares with such a stick.

- In other words, he bought

shares in the world's richest and most powerful corporation

with a stick of wood.

Winchester City Council Museums, CC BY-SA 2.0 , via Wikimedia Commons

Tally stick |

- It's ironic that after its formation in 1694, the Bank

of England attacked the tally stick system because it was money

outside the power of the money changers, just as King Henry I

had desired.

- Why do people accept sticks of wood for

money, that's a great question, the same as they accept a

piece of paper, they trusted it.

- Throughout history,

people would trade anything they thought had value and used it

as money, for example the taxpayers at the Jewish temples

would bring chickens and exchange them for shekels.

- So

the secret is that money is only what people agree on to use

as money.

- Like our paper money today, it's really just a

piece of paper, but here's the trick, King Henry I ordered

that tally sticks had to be used to pay his taxes.

- This

built in demand for tally sticks immediately made them

circulate and be accepted as money, and they worked well, in

fact no other form of money has worked as well for so long.

|

A tally stick was an ancient memory aid used to record and document numbers, quantities, and messages. Tally sticks first appear as animal bones carved with notches during the Upper Palaeolithic; a notable example is the Ishango Bone. Historical reference is made by Pliny the Elder (AD 23–79) about the best wood to use for tallies, and by Marco Polo (1254–1324) who mentions the use of the tally in China. Tallies have been used for numerous purposes such as messaging and scheduling, and especially in financial and legal transactions, to the point of being currency.

(Wikipedia)

|

Money circulating |

- Keep in mind, the British Empire was built under the

tally stick system and it succeeded, despite the fact that the

money changers constantly attacked it by offering the money

coin system as competition.

- In other words, metal coins

never went completely out of circulation, but tally sticks

were so successful because they were always good for tax

payment.

Classical Numismatic Group, Inc., CC BY-SA 3.0 , via Wikimedia Commons

Henry VIII

testoon |

- Finally, in the 1500s, King Henry VIII relaxed

the laws concerning usery, and the money changers wasted no

time reasserting themselves.

- They quickly made their gold

and silver coins plentiful for a few decades.

- Corrupt old

Henry VIII saw the advantage to this and he minted his

'coppernose' coins as silver but it was just a veneer and when

it rubbed off he had a copper nose on the coin and this was

called 'the Great Debasement.'

|

"Coppernose" refers to Henry VIII and his infamous

Great Debasement (1544-1551) in England, a period when

he drastically reduced the silver and gold content in

coins, adding copper to fund wars and lavish spending,

leading to inflation and the nickname because the

silver wore off the nose on his portrait, revealing

the base copper underneath. This policy eroded trust

in the currency and caused economic hardship, only

being reversed later under Edward VI and Elizabeth I.

(Assistant)

|

Queen Elizabeth I

takes the throne |

- However, when Queen Mary took the throne and tightened

the usery laws again, the money changers renewed the practice

of hoarding gold and silver coins, forcing the economy to

plummet.

- When Mary's sister, Queen Elizabeth I took the

throne, she was determined to regain control over English

money, something her father, Henry VIII had lost.

- Her

solution was to issue gold and silver coins from the public

treasury and remove control of the money supply from money

changers.

- Although control of money was not the only

cause of the English Revolution in 1642, religious differences

fueled the conflict, but monetary policy played a major role.

After Samuel Cooper, Public domain, via Wikimedia Commons

Oliver Cromwell |

- Financed by the money changers, Oliver Cromwell finally

overthrew King Charles I, purged the Parliament, and put the

king to death.

- The money changers were immediately

allowed to consolidate their financial power.

- The effect

was for the next 50 years, the money changers plunged Great

Britain into a series of costly wars.

- They took over a

square mile of property in the center of London known as the

City of London and this area today is still recognized as one

of the 3 predominant financial centers of the world.

-

Conflicts with the Scottish Stuart kings, led the money

changers in England to unite with those in the Netherlands to

finance the invasion of King William of Orange, who overthew

the Stuarts in 1688 and took the English throne.

Financial ruin |

- By the end of the 1600s, England was in financial ruin

because 50 years of more or less continuous wars with France

and Holland had exhausted resources.

- Frantic government

officials met with the money changers to beg for the loans

necessary to pursue their political purposes.

- The price

was high, a government sanctioned privately owned bank which could

issue money created out of thin air.

- It was to be the

modern world's first privately owned central bank, the Bank of

England, although it was deceptively named this to make the

general population think it was part of the government, it was

not.

- Like any other private corporation, the Bank of

England sold shares to get started.

City of London |

- The investors, whose names were never revealed, were

supposed to put up £1.4 million in gold coin to buy

their shares in the bank, but only £750,000 was ever received.

- Despite the huge shortfall, the bank was duly chartered in

1694 and began the business of loaning out several times the

money it supposedly had in reserves, all at interest.

- In

exchange, the new bank would loan British politicians as much

of the new currency as they wanted as long as they secured the

debt by direct taxation of the British people.

- So,

legalization of the Bank of England amounted to nothing less

than legal counterfeiting of a national currency for private

gain.

- Unfortunately, nearly every nation now has a

privately controlled central bank, using the Bank of England

as the basic model.

Central bank

control |

- Such is the power of these central banks that they soon

take total control over a nation's economy.

- It quickly

amounts to nothing but a plutocracy ruled by the rich, it

would be like putting control of the nation's army in the

hands of the mafia.

- The danger of tyranny would be

extreme but yes, we need central banks, however, we don't need

them in private hands.

- The central bank scam is really a

hidden tax because the nation sells bonds to the bank to pay

for things it does not have the political will to raise taxes

to pay for.

- But the bonds are purchased with money that

the central bank creates out of nothing and this is called

national debt.

- More money in

circulation, causes your money to be worth less.

|

Plutocracy, oligarchy, and kleptocracy all involve rule by a few, but differ in the basis of power: an oligarchy is rule by a small group (elite, military, etc.); a plutocracy is a type of oligarchy where wealth is the sole basis for power, often through legal policy; while a kleptocracy (rule by thieves) is a corrupt system where leaders use political power to steal state resources for personal enrichment, often secretly and illegally, subverting institutions for illicit gain. Plutocracies can be legalistic, while kleptocracies are defined by outright theft and corruption.

(Assistant)

|

Inflation |

- As a result, the government gets as much money as it

needs and the people pay for it in inflation.

- Sound

familiar?

- The beauty of the plan is that not one person

in a thousand can figure it out because its usually hidden

behind complex sounding economic gibberish.

- You need a

college degree in banking and finance to figure it out.

- With the

formation of the Bank of England, the nation was soon awash in

money, and prices throughout the country doubled.

- Massive

loans were granted for just about any wild scheme.

- One

venture proposed to drain the Red Sea to recover gold

supposedly lost when the Egyptian army drowned pursuing Moses

and Israelites.

Debt |

- By 1698, government debt grew from the initial

£1.4 million to £16 million.

- Naturally, taxes were

increased, and then increased again to pay for all of this.

- With the British money supply firmly in the bank's grip,

the economy began a wild roller coaster series of booms and

depressions, exactly the sort of thing a central bank claims

it is there to prevent.

- Sound familiar?

- There are

two things involved generally in the central bank, first is an

involvement in the formation of monetary policy with the

specific objective of achieving monetary stability.

-

However, since the Bank of England took control, the British

currency has rarely been stable.

Great coat of arms of Rothschild family |

- Now let's take a look at the Rothschild family,

the family that is said to be the wealthiest in the world.

- The Rothschild family is an Ashkenazi Jewish 'noble' banking family originally from Frankfurt

in Germany.

- The family's documented history starts in 16th-century

Frankfurt; its name is derived from the family house,

Rothschild, built by Isaak Elchanan Bacharach in Frankfurt in

1567.

- The first member of the family who was known to use the name

'Rothschild' was Isaak Elchanan Rothschild, born in 1577.

- Unlike most previous court factors, Rothschild managed to bequeath his wealth and established an international banking family through his

5 sons, who established businesses in Paris, Frankfurt, London, Vienna, and Naples.

|

Ashkenazi refers to Jews of Central and Eastern

European descent, named from the Hebrew word for

Germany, who developed distinct cultural, linguistic

(Yiddish), and religious traditions in the diaspora

after settling in the Rhineland and migrating

eastward. Today, they form a major branch of Judaism,

distinguished from Sephardic (Iberian/Middle Eastern)

or Mizrahi (Middle Eastern/North African) Jews by

unique customs, liturgy, and a shared history,

contributing significantly to global culture, science,

and arts.

(Assistant)

|

Gold miners |

- The family was elevated to noble rank in the Holy Roman Empire and the United Kingdom,

however, the only subsisting branches of the family are the French and British.

- During the 19th-century, the Rothschild family possessed the largest private fortune in the world, as well as in modern world history.

- The Rothschild family dominated international finance in Europe between the 1820s and the 1870s, when their hegemony over European finance was broken by joint stock banks.

- The family's wealth declined over the 20th-century and was divided among many descendants,

however, they remain incredibly wealthy.

- Today, their assets cover a diverse range of sectors, including financial services, real estate, mining, energy, agriculture, and winemaking.

|

Rothschild means "red shield" in German, a name taken from a house sign in Frankfurt's Jewish ghetto by the famous banking dynasty founded by Mayer Amschel Rothschild (1744-1812). The name signifies a wealthy, influential European banking family known for international finance, with branches established by Mayer's five sons in London, Paris, Vienna, Naples, and Frankfurt, becoming synonymous with immense wealth and financial power.

(Assistant)

|

Public domain, via Wikimedia Commons

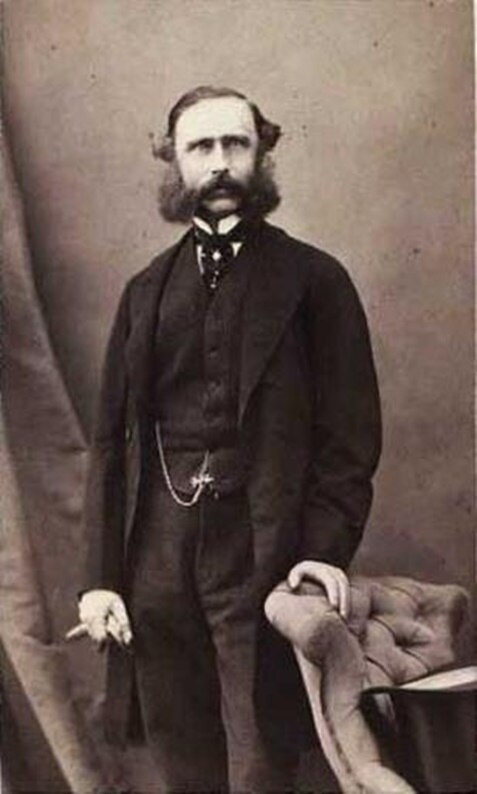

Mayer Amschel Rothschild |

- The family's ascent to international prominence began in 1744, with the birth of

Mayer Amschel Rothschild

(1744-1813) in Frankfurt am Main, Germany.

- He was the

son of Amschel Moses Bower Rothschild (born circa 1710) a money changer who had traded with the Prince of Hesse.

|

The name is derived from the German zum rothen Schild (with the old spelling "th"), meaning "at the red shield", in reference to the house where the family lived for many generations (in those days, houses were designated not by numbers, but by signs displaying different symbols or colours).

(Wikipedia)

|

|

Fred Trump as

Mayer Amschel Rothschild |

|

|

Frederick Christ Trump Sr.

1905-1999

10/11 6/25

Real estates |

Mayer Amschel Rothschild

1744-1813

2/23

9/19 |

|

|

|

Money changer |

- Some 50 years after the Bank of England opened its

doors, a goldsmith in Frankfurt named Amschel Moses

Bower opened a coin shop, or counting house, in 1743.

-

Over the door he placed a sign depicting a Roman eagle on a

red shield, and the shop became known as the 'Red Shield'

firm, or in German, Rothschild.

- When his son, Amchel

Mayer Bower inherited the business, he decided to change his

name to Rothschild.

- He soon learned that lending money to

governments and kings was more profitable than loaning to

private individuals.

- Not only were the loans bigger, but

they were secured by the nation's taxes.

Shielded |

- In 1785, Amchel Mayer Rothschild moved his entire family to

a larger house in Frankfurt, a 5-story dwelling he shared with

the Schiff family.

- This house was known as the 'Green

Shield,' and both the Rothschild's and the Schiff's would play

a central role in the rest of European financial history, and

of that in the U.S.

- Rothschild had 5 sons and he trained them

all in the skills of money creation, then sent them out to the

major capitals of Europe to open branch offices of the family

banking business.

Greedy bankers |

- His 1st son,

Mayer Amschel Rothschild stayed in Frankfurt

to mind the hometown bank.

- The 2nd son, Solomon

Rothschild, was sent to Vienna, while his 3rd son, Nathan

Rothschild, was clearly the most clever and he was sent to

London at age 21 in 1798.

- This was some 100 years after

the founding of the Bank of England.

- His 4th son, Carl

Rothschild, went to Naples, and his 5th son, Jacob Rothschild,

went to Paris.

G. Le Gray & Cie, Public domain, via Wikimedia Commons

Frederick William

II of Hesse-Kassel |

- The Rothschild's broke into dealings with European

royalty at Williams Hall, the palace of the wealthiest man in

Germany.

- In fact, the wealthiest monarch in Europe,

Prince William of Hesse-Kassel.

- At first the Rothschild's

were only helping William speculate in precious coins,

however, when Napoleon chased the prince into exile, he sent

£550,000, a gigantic sum at that time, to Nathan Rothschild in

London with instructions to buy 'consoles,' British government

bonds, also called government stock.

- But Rothschild used

the money for his own purposes; with Napoleon on the loose,

the opportunities of wartime investments were nearly

limitless.

|

Prescott Bush as Prince William |

|

|

Prescott Sheldon Bush

1895-1972

5/15 10/8

Nazi support |

Prince William

1787-1867

12/24

9/5

Hesse-Kassel |

|

|

|

Hessian |

- Prince William returned to his palace sometime prior

to the Battle of Waterloo in 1815 and he summoned Rothschild

and demanded his money back.

European royalty |

- The Rothschld's returned Prince William's money with the

interest the British consoles would have paid him, had the

investment actually been made.

- But the Rothchild's kept

all the past profits they had made using William's money.

-

Nathan Rothschild later bragged that in the 17 years he had

been in Britain, he increased his original £20,000 stake given

to him by his father, some 2,500 times.

- By cooperating

within the family, the Rothschild soon grew unbelievably

wealthy and by the 1800s they dominated all European banking

and were certainly the wealthiest family in the world.

.jpg)

Alexander Bassano, Public domain, via Wikimedia Commons

Cecil John Rhodes -

1890 |

- Cecil John Rhodes (1853-1902) was a British mining magnate and politician in southern Africa who served as Prime Minister of the Cape Colony from 1890 to 1896.

- He and his British South Africa Company founded the southern African territory of Rhodesia (now Zimbabwe and Zambia), which the company named after him in 1895.

- He also devoted much effort to realising his vision of a Cape to Cairo Railway through British territory.

- Rhodes set up the Rhodes Scholarship, which is funded by his estate.

|

Elon Musk as Cecil Rhodes |

|

|

Elon Reeve Musk

1971

6/28

Emeralds |

Cecil John Rhodes

1853-1902

7/5

3/26

Diamonds |

|

|

|

Diamonds or Emeralds |

- The Rothschild bank financed Cecil Rhodes which allowed him to

establish a monopoly over the diamond and gold fields of South

Africa.|

- He founded the De Beers company in 1888 after he

was financed by the South African diamond magnate Alfred Beit

and the London-based N M Rothschild & Sons bank.

- Elon

Musk's father Errol Musk, was given an emerald mine by De

Beers for some reason.

|

The idea that Elon Musk's father, Errol, owned an emerald mine, possibly given by De Beers, is a persistent but disputed rumor; Errol claims he had access to Zambian emeralds through deals, not ownership, and denies it funded Elon, while Elon has called the mine story "fake," though past interviews show confusion, with Errol saying his son saw the gems and knows the truth, while Elon denies it to portray a harder upbringing.

(Assistant)

|

Great wealth |

- In America, the Rothschild bank financed the Harriman's and the

railroads, and the Vanderbilt's and railroads and the news

press as well as Carnegie and the steel industry, among many

others.

- In fact, during World War I, J.P. Morgan was

thought to be the richest man in America, but after his death,

it was discovered that he was only a lieutenant of the

Rothschild's.

- Once Morgan's will was made public, it was

discovered that he owned only 19% of J.P. Morgan companies.

|

J.P. Morgan wasn't exactly a "lieutenant," but he and his father, Junius Spencer Morgan, had extremely close, mutually beneficial ties with the powerful Rothschild banking dynasty, essentially acting as their American partners, expanding Morgan's firm (J.P. Morgan & Co.) through Rothschild trust, shared deals, and connections, establishing an international financial powerhouse based on trust and collaboration, a model J.P. Morgan expanded globally.

(Assistant)

|

World standing |

- By 1850, James Rothschild, the heir of the French branch

of the family, was said to be worth 600 million French francs,

150 million more than all the other bankers in France put

together.

- He built a mansion near Paris so large that

even Prince William Hesse-Kassel exclaimed, 'Kings couldn't afford this, it

could only belong to a Rothschild.'

- Another 19th-century

French commentator put it this way, 'There is but one power in

Europe and that is Rothschild.'

- There is no evidence that

their predominant standing in European or world finance has

ever changed.

American Revolution |

- It's claimed that the results of what the Bank of

England had produced on the British economy was the root cause

of the American Revolution.

- By the mid-1700s, the British

Empire was nearing its height of power around the world, but

Britain had fought 4 costly wars in Europe, just since the

creation of their privately owned central bank and the cost

had been high.

- To finance these wars, the British

Parliament had borrowed heavily from the bank and by the

mid-1700s, the government's debt was £140 million, a

staggering amount for those days.

- Consequently, the

British government embarked on a program attempting to raise

revenue from their American colonies in order to make their

interest payments to the bank.

The Wild Western

colonies |

- But in America, it was a different story because the

scourge of a privately owned central bank had not yet hit.

- In the mid-1700s, pre-revolutionary America was still

relatively poor and there was a severe shortage of precious

metal coins to trade for goods.

- Because of this, the

early colonists were forced to experiment with printing their

own homegrown paper money.

- Some of these experiments were

successful and Benjamin Franklin was a big supporter of the

colonies printing their own money.

- He owned the printing

presses.

- In 1757, Franklin was sent to London and he

ended up staying for the next 18 years, nearly to the

beginning of the American Revolution.

-Pennsylvania-18_Jun_1764.jpg)

Benjamin Franklin and David Hall (printers), Public domain, via Wikimedia Commons |

- During this period, the colonies began to issue their

own paper money called Colonial Scrip.

- The endeavor was

very successful because it provided a reliable medium of

exchange and it also helped to provide a feeling of unity

between the colonies.

- Colonial Scrip was debt-free paper

money printed in the public interest and not backed by gold or

silver coin, in other words, it was a totally fiat

currency.

- Officials at the Bank of England asked Franklin

how he would account for the new found prosperity of the

colonies and without hesitation he told them it was because

the colonies issued their own money.

- Also, that it was

issued in proper proportion to the demands of trade and

industry to make products pass easily from the producers to

the consumers, and because of that, the colonies owed interest

to no one.

|

Fiat currency is a type of money issued by a government and declared legal tender, but which is not backed by a physical commodity like gold or silver. Its value is based entirely on the public's trust and confidence in the issuing government and the stability of the economy, rather than any intrinsic value.

(Assistant)

|

Colonial

Scrip by Franklin |

- This was just common sense to Franklin, but you can

imagine the impact it had on the Bank of England.

- America

had learned the deep secret of money and that genie had to be

returned to its bottle as soon as possible.

- As a result,

Parliament hurriedly passed the Currency Act of 1764

and this prohibited colonial officials from issuing their own

money and ordered them to pay all future taxes in gold or

silver coins.

- In other words, it forced the colonies onto

a gold or silver standard.

- For those who still believe

that a gold standard is the answer for America's current

currency problems, look what happened to America after that.

America |

- Franklin wrote in his autobiography that in one short

year, the conditions were so reversed that the era of

prosperity ended and a depression set in.

- To such an

extent that the streets of the colonies were filled with

unemployed and he claimed that this was the basis for the

American Revolution.

- Britain took away the colonies

money, which created unemployment and dissatisfaction.

-

The inability of the colonists to get power to issue their own

money and keep it out of the hands of George III and the

international banks was the main reason for war.

|

In letters around 1773, Franklin expressed that the small 3-pence tax on tea was "silly" and a poor excuse for a revenue tax, as it was less than the English paid and made tea cheaper in America, but it was kept by Britain to assert their right to tax the colonies, which Franklin felt would provoke more serious conflict over principle, not money, ultimately leading to the Boston Tea Party.

(Assistant)

|

Colonial homes |

- By the time the first shots were fired in Lexington,

Massachusetts, on April 19th, 1775, the colonies had been

drained of gold and silver coin by British taxation.

- As a

result, the Continental government had no choice but to print

money to finance the war.

- At the start of the revolution,

the colonial money supply stood at $12 million but by the end

of the war, it was nearly $500 million.

- And the currency

as a result, was nearly worthless.

- For example, shoes

sold for $5,000 a pair and the whole reason that Colonial

Scrip had worked was because just enough was issued to

facilitate trade.

- As George Washington lamented, 'A wagon

load of money will scarcely purchase a wagon load of

provisions.'

Soapbox |

- Today, those who support a goldbacked currency point to

this period to demonstrate the evils of a fiat currency.

-

But remember, that same currency had worked so well 20 years

earlier during times of peace that the Bank of England had

Parliment outlaw it.

- Toward the end of the revolution,

the Continental Congress meeting at Independence Hall in

Philadelphia, grew desperate for money.

- In 1781, they

allowed Robert Morris, their financial superintendent, to open

a privately owned central bank.

- Incidently, Morris was a

wealthy man who had grown even wealthier during the revolution

by trading war materials.

Robert Edge Pine, Public domain, via Wikimedia Commons

Robert Morris |

- Robert Morris Jr. (1734-1806) was a British-born

American merchant, investor, and politician, and one of the Founding Fathers of the United States.

- Morris served in the Pennsylvania legislature, the Second Continental Congress, and the United States Senate.

- He was one of only two individuals (along with Roger Sherman) to sign the

Declaration of Independence, the Articles of Confederation, and the U.S. Constitution.

- From 1781 to 1784, he held the post of Superintendent of Finance of the United States, a role that earned him the title

'Financier of the Revolution.'

|

John D. Rockefeller as Robert Morris |

|

|

John Davison Rockefeller

1839-1937

7/8 5/23 |

Robert Morris Jr.

1734-1806

1/20

5/8

War and money |

|

|

|

War debt |

- Alongside Alexander Hamilton and Albert Gallatin, Morris is often regarded as a founder of the financial system of the United States.

- Morris called the entity, the Bank of Northern America and

it was closely modeled after the Bank of England.

- It was

allowed to practice fractional reserve banking, meaning it

could lend out money it didn't have and then charge interest.

- If any of us tried doing that, we would be charged with

fraud, a felony.

Bank of North

America |

- The new banks charter called for private investors to

put up $400,000 worth of initial capital.

- When Morris was

unable to raise the money, he brazenly used his political

influence to have gold deposited in the bank, which had been

loaned to America by France.

- He then loaned this money to

himself and his friends to reinvest in shares of the bank.

John Trumbull, Public domain, via Wikimedia Commons

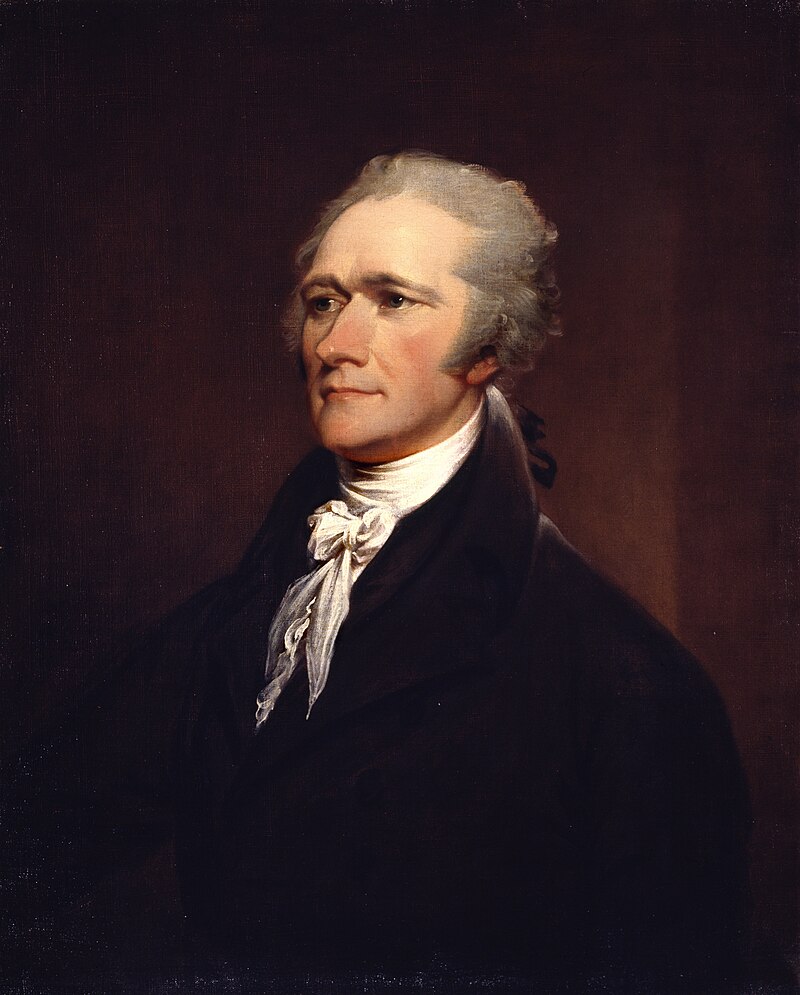

Alexander Hamilton

1794 |

|

- Just like the Bank of England, the new bank was given a

monopoly over the national currency.

- Soon the dangers

became clear, the value of American currrency continued to

plummet.

- Four years later, in 1785, the banks charter was

not renewed.

- The leader of the effort to kill the bank,

William Findley of Pennsylvania, explained that 'the

institution had no principle but that of avarice.'

|

George Bush Jr. as Alexander Hamilton |

|

|

George Walker Bush

1946

7/6 |

Alexander Hamilton

1755-1804

1/11

7/12

British spy |

|

|

|

Kite steel hit plane |

- Lesson 60 on page 153.

.jpg)

John Wollaston the Younger, Public domain, via Wikimedia Commons

Thomas Willing |

|

- Thomas Willing (1731-1821) was an American merchant, politician, and slave trader.

- He served as mayor of Philadelphia and as a delegate from Pennsylvania to the Continental Congress.

- He was also the first president of the Bank of North America and later of the First Bank of the United States.

|

George Bush Sr. as Thomas Willing |

|

|

George Herbert Walker Bush

1924-2018

6/12 11/30 |

Thomas Willing

1731-1821

12/19

8/19

Banker |

|

|

|

Skull and bones |

- The men behind the Bank of North America, Alexander

Hamilton, Robert Morris, and the bank's president, Thomas

Willing, did not give up.

Assets |

- Only 6 years later, Hamilton,

then Secretary of Treasury, and his mentor, Robert Morris,

were able to ram a new privately owned central bank through

the new U.S. Congress.

- Called the First Bank of the

United States, Thomas Willing again served as the bank's

president.

- The players of the bank were the same, only

the name was changed.

- In 1787, colonial leaders assembled

in Philadelphia to replace the ailing Articles of

Confederation.

- As we saw before, both Jefferson and

Madison were still opposed to a privately owned central bank.

Problems |

- Both men had seen the problems caused by the Bank of

England and they wanted nothing of it.

- During the debate

with the Founding Fathers, Governor Morris castigated the

motivations of the owners of the Bank of North America.

-

Governor Morris was head of the committee that wrote the final

draft of the Constitution.

- He knew the motivations of the

bank well, along with his old boss, Robert Morris, Governor

Morris and Alexander Hamilton were the ones who had presented

the original plan for the bank to the Continental Congress in

the last year of the revolution.

- In a letter he wrote to

James Madison on July 2, 1787, the governer revealed what

was really going on.

- He knew that the rich would strive

to establish their dominion and enslave the rest because

that's what they always did.

|

If the American people ever allow private banks to control the issue of their currency, first by inflation, then deflation, the banks and the corporation which grow up around them will deprive the people of all property until their children wake up homeless on the continent their fathers conquered.

(Thomas Jefferson)

|

Convincing |

- Despite the defection of Governor Morris from the ranks

of the bank, Hamilton, Robert Morris, Thomas Willing and their

European backers were not about to give up.

- They

convinced the bulk of the delegates to the Constitutional

Convention to not give Congress the power to issue paper

money.

- Most of the delegates were still reeling from the

wild inflation of the paper currency during the revolution.

- They had forgotten how well Colonial Scrip had worked before

the war.

- But the Bank of England had not, and they could

not stand to have America printing their own money again.

-

Unfortunately, the Constitution is silent on this

grievous defect and this left the door wide open to the

private bankers, just as they had planned.

Sruck again |

- In 1790, less than 3 years after the Constitution

had been signed, the money changers struck again.

- The

newly appointed first Secretary of the Treasury, Alexander

Hamilton, proposed a bill to Congress calling for a new,

privately owned central bank.

- Conincidently, that was the

very year that Amschel Rothschild made a pronouncement from

his flagship bank in Frankfurt saying, 'Let me issue and

control a nation's money and I care not who writes the laws.'

- Alexander Hamilton revealed himself to be a tool of the

international bankers and he wanted to create the Bank of the

United States and did so.

Hamilton's national

blessing to whom? |

- Interestingly, one of Hamilton's first jobs after

graduating from law school in 1782, was as aide to Robert

Morris, the head of the Bank of North America.

- In fact,

the year before, he had written Morris a letter saying, 'A

national debt, if it is not excessive, will be to us a

national blessing.'

- After a year of intense debate, in

1791, Congress passed the bill and gave it a 20 year charter.

- The new bank was to be called the First Bank of the United

States (BUS).

- They were granted a monopoly on printing

U.S. currency, even though 80% of its stock would be held by

private investors.

- The other 20% would be purchased by

the U.S. government.

- However, the reason was not to give

the U.S. government a piece of the action, it was to provide

the capital for the other 80% owners.

BUS |

- As with the old Bank of North America and the Bank of

England before that, the stockholders never paid the full

amount for their shares.

- Instead, the U.S. government put

up their initial $2 million in cash.

- Then the bank,

through their old magic of fractional reserve lending, made

loans to its charter investors so they could come up with the

remaining $8 million in capital needed for this 'risk free'

investment.

- Like the Bank of England, the name for the

bank in the U.S. was chosen to deliberately hide that it was

privately controlled.

- And like the Bank of England, the

investors were never revealed.

- Many years later, it was a

common saying that the Rothschild's were the power behind the

old bank of the U.S.

Congressional

security is war |

- The bank was sold to Congress as a way to bring

stability to the banking system and eliminate inflation.

-

So what happened next?

- Over the first 5 years, the U.S.

government borrowed $8.2 million from the Bank of the United

States.

- In the same 5-year period, prices rose by 72%.

- Jefferson, as new Secretary of State watched the borrowing

with sadness and frustration, unable to stop it.

- Also as

one of the Founding Fathers he signed the Constitution

with no provision for any of this?

|

|

|

Head shape shifting

demon |

- The Secretary of State (U.S.) is the President's chief foreign policy advisor, heading the State Department, managing foreign relations, negotiating treaties, issuing passports, and protecting U.S. citizens abroad; at the state level, they often serve as chief election official, keeper of state records (like the Great Seal),

registrar of businesses, and commissioner of notaries, with roles varying by state.

- So you have to wonder, why Jefferson was unable to stop

it if he's the one in control of registering businesses?

-

He was quoted as saying, 'I wish it were possible to obtain a

single amendment to our Constitution, taking from the federal

government their power of borrowing.'!!!!!

Out on the ledge |

- Millions of Americans want the ability to add an

amendment to the Constitution, so why were the Founding

Fathers so careful not to allow this to happen?

- They

watch in helpless frustration as the federal government

borrows the American economy into oblivion.

- To the point

now they are tearing down the White House without any approval

to build 'ball rooms' to take the scapegoated Edomites to hell for the

Jews crimes.

- Despite being called the First Bank of the

United States, it was not the first attempt at a privately

owned central bank in this country.

- As with the Bank of

North America, the government put up most of the cash to get

this bank going.

- Then the bankers loaned the money to

each other to purchase the remaining stock in the bank.

Public hanging |

- It was a scam, plain and simple, and they wouldn't be

able to get away with it for long.

- We have to travel back

to Europe to see how a single man was able to manipulate the

entire British economy by obtaining the first news of

Napoleon's final defeat.

- The Bank of France was organized

in Paris in 1800, just like the Bank of England.

- But

Nepoleon decided France had to break free of debt and he never

did trust the Bank of France.

- He declared that when a

government is dependent upon bankers for money, the bankers,

not the leaders of the government are in contol.

-

Back in America, unexpected help was about to arrive.

|

The hand that gives is above the hand that takes.

Money has no motherland; financiers are without

patriotism and without decency; their sole object is

gain..

(Napoleon Bonaparte)

|

Jacques-Louis David, Public domain, via Wikimedia Commons

Napoleon Bonaparte |

- In 1800, Thomas Jefferson narrowly defeated John Adams

to become the 3rd president of the U.S.

- By 1803,

Jefferson and Napoleon had struck a deal, the U.S. would give

Napoleon $3 million in gold in exchange for a huge chuck of

territory west of the Mississippi River and this was the

Louisiana Purchase.

- With that $3 million Napoleon quickly

forged an army and set off across Europe, conquering

everything in his path.

- But the Bank of England quickly

rose to oppose him.

Monti-cello |

- They financed every nation in his

path, reaping the enormous profits of war.

- Prussia,

Austria and finally, Russia all went heavily into debt in a

futile attempt to stop Napoleon.

- Four years later, with the main French army in Russia,

30-year-old Nathan Rothschild, the head of the London office

of the Rothschild family, personally took charge of a bold

plan to smuggle a much needed shipment of gold right through

France to finance an attack by the Duke of Wellington that

took place in

Spain.

Thomas Lawrence, Public domain, via Wikimedia Commons

The Duke of

Wellington, c.1815 - upper

house

Tory |

- Field Marshal Arthur Wellesley (1769-1852), 1st Duke of Wellington (né Wesley) was an Anglo-Irish British Army officer and statesman who was one of the leading military and political figures in Britain during the early 19th-century, twice serving as Prime Minister of the United Kingdom.

- He was one of the British commanders who ended the Anglo-Mysore wars by defeating Tipu Sultan in 1799, and among those who ended the Napoleonic Wars in a Coalition victory when the Seventh Coalition defeated Napoleon at the Battle of Waterloo in 1815.

|

Duke of Wellington as Napoleon Bonaparte |

|

|

Arthur Wellesley

1769-1852

5/1 9/14

Prime Minister |

Napoleon Bonaparte

11769-1821

8/15

5/5

Emperor |

|

|

|

My sore |

- Rothschild later bragged at a dinner party in

London, that it was the best business he's ever done.

-

Little did he know that he would do much better business in

the near future.

- Wellington's attacks from the south and

other defeats eventually forced Napoleon to abdicate and Louis

XVIII was crowned.

Elba |

- Napoleon was exiled to Elba, a tiny island off the coast

of Italy, supposedly exiled from France forever.

- While

Napoleon was exiled and temporarily defeated by England with

the financial help of the Rothschild bank, America was trying

to break free of its central bank as well.

- In 1811, a

bill was put before Congress to renew the charter of the Bank

of the United States.

- The debate grew very heated and the

legislatures of Pennsylvania and Virginia, passed resolutions

asking Congress to kill the bank.

- The press corp of the

day attacked the bank openly calling it a great swindle, a

vulture, a viper and a cobra.

- How nice it would be to

have an independent press again in America.

War bank |

- A congressman named P.B. Porter attacked the bank from

the floor of Congress saying, 'if the banks charter is

renewed, Congress will have planted in the bosom of this

Constitution, a viper, which one way or another, will sting

the liberties of this country to the heart.'

- Prospects

didn't look that good for the bank but some claim that Nathan

Rothschild was quoted as saying that the U.S. would find

itself in the most disastrous war if the banks charter were

not renewed!!

- But it wasn't enough, when the smoke had

cleared, the renewal bill was defeated by a single vote in the

House, and was deadlocked in Senate.

Whitehouse |

- By now, America's 4th president, James Madison, was in

the White House and he was a staunch oppenent of the central

bank.

- His vice president, George Clinton, broke a tie in

the Senate and sent the bank into oblivion.

- Within 5

months, England attacked the U.S. and the War of 1812 was on.

- But the British were still busy fighting Napoleon, so the

War of 1812 ended in a draw in 1814.

- Though the money

changers were temporarily down, they were far from out.

-

It would take them only another 2 years to bring back their

bank, bigger and stronger than ever.

Banking house |

- Nothing in history more aptly demonstrates the ingenuity

of the Rothschild than their control of the British stock

market after Waterloo.

- In 1815, a year after the end of

the War of 1812 in America, Napoleon escaped his exile and

returned to Paris.

- French troops were sent out to capture

him, but such was his charisma that soldiers hailed around

their old leader and hailed him as their emperor once again.

- In March of 1815, Napoleon outfitted an army which Britain's

Duke of Wellington defeated less than 90 days later at

Waterloo.

- Some writers claim that Napoleon borrowed £5

million from the Bank of England to re-arm, but it appears

these funds actually came from the Hubbard Banking House in

Paris.

- Nevertheless, from about this point on, it was not

unusual for privately controlled central banks to finance both

sides in a war.

War is debt |

- Why would a central bank finance opposing sides in a

war?

- Because war is the biggest debt generator of them

all because a nation will borrow any amount for victory.

-

The ultimate loser is loaned just enough to hold out the vain

hope of victory, and the ultimate winner is given enough to

win.

- Besides, such loans are usually conditioned upon the

guarantee that the victor will honor the debts of the

vanquished.

- The Waterloo battlefield is located about 200

miles northeast of Paris in what today is Belgium.

- It is

here that Napoleon suffered his final defeat, but not before

thousands of French gave their lives on a summer day in July

1815.

- On June 18, 1815, some 74,000 French troops met

67,000 troops from Britain and other European nations.

-

The outcome was certainly in doubt, in fact, Napoleon had

attacked a few hours earlier, he would have probably won the

battle.

Big bank |

- But no matter who won or lost, back in London, Nathan

Rothschild made plans to use the opportunity to try and seize

control over the British stock and bond market, and possibly,

even the Bank of England.

- Rothschild stationed a trusted

agent, a man named Rothworth on the north side of the

battlefield, closer to the English Channel.

- Once the

battle had been decided, Rothworth took off and he delivered

the news to Nathan Rothschild a full 24-hours before

Wellington's own courier reached England.

- Rothschild

hurried to the stock market and took up us usual position in

front of an ancient pillar.

See page for author, Public domain, via Wikimedia Commons

Nathan

Rothschild |

- All eyes were on him because the Rothschild's had an

ancient communications network.

-

If Wellington had been defeated and Napoleon was on the loose

on the continent again, Britain's financial situation would

become grave indeed.

- Rothschild looked saddened and he

stood there motionless with his eyes downcast, then suddenly

he began selling.

- Other nervous investors saw that he was

selling and it could have only meant one thing, Napoleon must

have won and Wellington must have lost.

- The market

plummeted and soon everyone was selling their consoles,

British government bonds, and prices dropped sharply.

-

However, Rothschild started secretly buying up the consoles

through his agents for only a fraction of their worth a few

hours before.

- How perfectly despicable and deceptive.

Soldiers returning |

- Myths, legends, some claim, but 100 years later, the New

York Times ran a story that said that Nathan Rothschild's

grandson had attempted to secure a court order to suppress a

book that had the stock market story in it.

- The

Rothschild family claimed the story was untrue and liabilious,

however, the court denied their request and ordered the family

to pay all court costs.

- What's even more interesting

about this story is that some authors claim that the day after

the Battle of Waterloo, in a matter of hours, Nathan

Rothschild came to dominate not only the bond market, but the

Bank of England as well.

Family logo |

-Whether or not the Rothschild family seized control of

the Bank of England, the first privately owned central bank in

a major European nation and the wealthiest, one thing is

certain.

- By the 1800s. they were the wealthiest family in

the world, bar none.

- They dominated the new government

bond markets and branched into other banks and industrial

concerns.

- In fact, the rest of the 19th-century was known

as the Age of the Rothschild's and it's been estimated that

they controlled half the wealth of the world.

- Despite

this overwhelming wealth, the family has generally cultivated

an aura of invisibility, although the family controls scores

of industrial, commercial, mining and tourist centered

corporations, only a handful bear their name.

- Somehow

since the turn of the century, the Rothschild's have

cultivated the notion that their power has somehow waned, even

as their wealth increases.

Shady business |

- Meanwhile back in Washington in 1816, just one year

after Waterloo and the Rothschild's alleged takeover of the

Bank of England, the American Congress passed yet another bill

permitting yet another privately owned central bank.

- This

bank was called the Second Bank of the United States and the

charter was a copy of the previous banks.

- The U.S.

government would own 20% of the shares of the bank, of course

the federal share was paid by the U.S. Treasury upfront into

the banks coffers.

- Then, through the magic of fractional

reserve lending, it was transformed into loans to private

investors who then bought the remaining 80% of the shares.

- Just as before, the primary stockholders remained a secret.

- However, it is known that the largest block of shares, about

one-third of the total, were sold to foreigners.

Shareholders |

- As one observer put it, that it is certainly no

exaggeration to say that the Second Bank of the United States

was rooted as deeply in Britain as it was in America.

- By

1816, it's claimed that the Rothschild's had taken control

over the Bank of England and had backed a new privately owned

central bank in America as well.

- After 12 years of

manipulation of the U.S. economy on the part of this latest

bank, the American people had had just about enough.

-

Opponents of the bank nominated a dignified senator from

Tennessee, Andrew Jackson, the hero of the Battle of New

Orleans, to run for president.

.jpg)

Ralph Eleaser Whiteside Earl, Public domain, via Wikimedia Commons

Andrew Jackson -

7th president |

- Initially, no one gave Andrew Jackson a chance and the

bank had learned long ago how the political process could be

controlled with money.

- To the surprise and dismay of the

money changers, Jackson was swept into office in 1828.

- He

was determined to kill the central bank at the first

opportunity and wasted no time in trying to do so.

-

However, the banks 20 year charter didn't come up for renewal

until 1836, the last year of his 2nd term, if he could survive

that long.

- During his first term, Jackson contented

himself with rooting out the bank's many minions from

government service.

Capital doings |

- Jackson fired 2,000 of the 11,000 employees of the federal

government.

- In 1832, with his

re-election approaching, the banks struck an early blow,

hoping that Jackson would not want to stir up controversy.

- They asked Congress to pass a renewal bill 4 years early and

naturally Congress complied and sent it to the president to

sign.

- But Jackson weighed in with both feet, Old Hickory,

never a coward, vetoed the bill.

- His veto message is one

of the great American documents as it clearly laid out the

responsibility of American government towards its citizens,

rich and poor.

Citizens should

matter |

- Jackson was angered that 8 million shares

of stock in the bank were owned by foreigners.

- He

questioned what danger to our liberty and independence is

placed in a bank that in its nature has so little to bind it

to our country.

- Jackson stated that foreigners were

controlling our currency, receiving our public moneys, and

holding thousands of citizens in dependence, and felt that was

more formidable and dangerous than a military power of the

enemy.

- He felt that the document that had been placed in

front of him to sign, was a wide and unnecessary

departure from these just principles.

|

The duty of government is to leave commerce to its own capital and credit as well as all other branches of business, protecting all in their legal pursuits, granting exclusive privileges to none.

(Andrew Jackson)

|

Attempt to override

presidential veto

landslide |

- Later that year, in July 1832, Congress was unable to

override Jackson's veto, although they tried.

- Now Jackson

had to stand for re-election so he took his argument directly

to the people.

- For the first time in U.S. history, he

took his presidential campaign on the road.

- Before that,

presidential candidates stayed at home and looked

presidential.

- His campaign slogan was 'Jackson and no

bank.'

- The Republican Party ran Senator Henry Clay

against Jackson, and despite the fact that the bankers poured

over $3 million into Clay's campaign, Jackson was re-elected

in a landslide in November 1832.

Battle only

beginning |

- Despite his presidential victory, Jackson knew the

battle was only beginning.

- The newly elected Jackson

said, 'The hydra is only scotched, not dead.'

- He ordered

his new Secretary of the Treasury to start removing the

governments deposits from the second bank and place them in

state banks.

- However, the Secretary of the Treasury

refused to do so, and Jackson fired him and appointed William

J. Dwayne as the new secretary and he also refused to comply

with Jackson's requests.

- So Jackson fired him as well and

appointed a third man to the office, Roger B. Taney,

-

Taney began withdrawing government funds from the bank

starting on October 1, 1833, and Jackson was jubilant.

William Inman, Public domain, via Wikimedia Commons

Arrogant banker Nicholas Biddle |

- But the bank was not yet done fighting and the head of

the bank, Nicholas Biddle, used his influence to get Senate to

reject Taney's nomination.

- Then in a rare show of

arrogance, Biddle threatened to cause a depression if the bank

was not re-chartered.

- Biddle made the statement that,

'This worthy president thinks that because he has scalped

Indians and imprisoned judges, he is to have his way with the

Bank and he is mistaken.'

- Next, in an unbelievable fit of

honesty for a central banker, Biddle admitted that the bank

was going to make money scare to force Congress to restore the

bank.

- He claimed it would cause widespread suffering and

that the banks only safety was in pursuing a steady course of

firm restriction and that he had no doubt that such a course

would ultimately lead to the restoration of the currency and

the recharter of the bank.

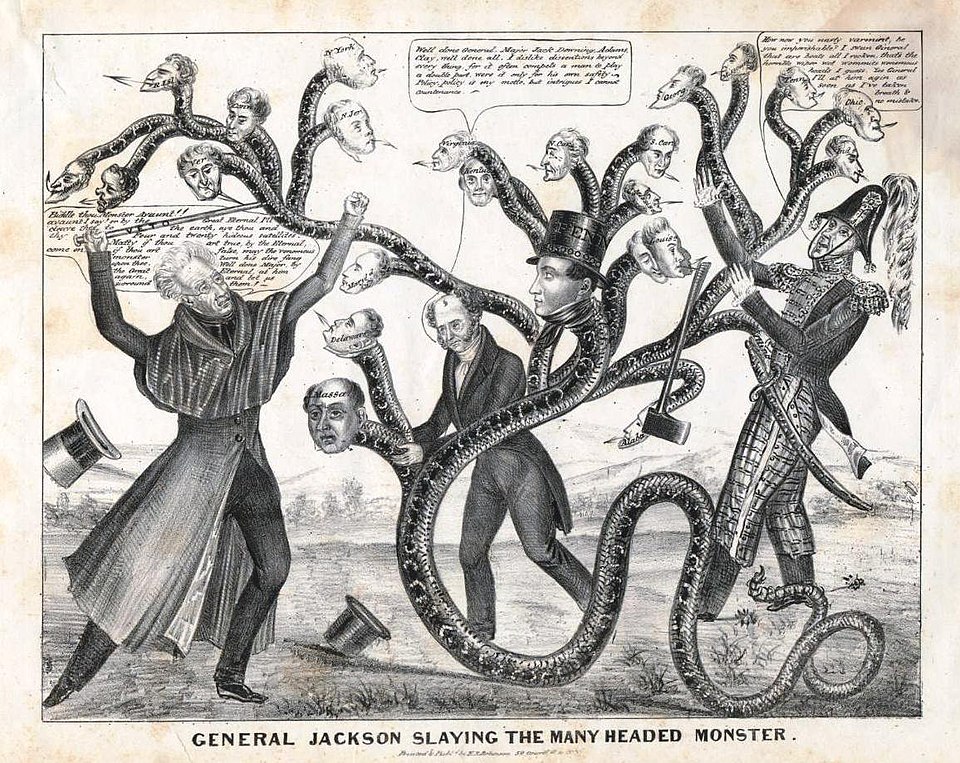

N.Y. : Printed & publd. by H.R. Robinson, 1836; cropped by Beyond My Ken (talk) 07:04, 16 June 2010 (UTC), Public domain, via Wikimedia Commons |

- What a stunning revelation, here was the pure truth

revealed with shocking clarity what these central bankers were

willing to do.

- Biddle intended to use the money

contraction power of the bank to cause a massive depression

until America gave in.

- Unfortunately, this has happened

time and time again throughout U.S. history.

- Biddle made

good on his threat and the bank sharply contracted the money

supply by calling in old loans and refusing to extend new

ones.

- A financial panic ensued, followed by a deep

depression and naturally Biddle blamed Jackson for the crash

saying that it was caused by the withdrawal of federal funds

from the bank.

- Unfortunately, his plan worked well and

wages and prices were depressed, unemployment soared along

with business bankruptcies.

Unemployment soared |