|

|

ABEL GRIMMER - TOWER OF BABEL - PAGE 6

|

Central Bank

Rapes America |

Landslide |

- Unfortunately, even with all the resistance that

President Andrew Jackson devoted to the cause of freeing

Americans from the grips of the demonic international bankers,

he failed to grasp the entire picture and recognize the root

cause.

- Although Jackson had killed the privately owned

central bank, the most isidious weapon of the money changers

fractional reserve banking, remained in use by the numerous

state chartered banks.

Terre Haute Wabash

Courier

- May 25, 1849 |

- This fueled economic instability

in the years before the Civil War.

- Still, the private

central bankers were out of the game and as a result, America

thrived as it expanded westward.

- During this time, the

principal money changers struggled to regain their lost

centralized power, but to no avail.

|

The duty of government is to leave commerce to its own capital and credit as well as all other branches of business, protecting all in their legal pursuits, granting exclusive privileges to none.

(Andrew Jackson)

|

Slavery |

- Then, finally, they reverted back to the old central

banker's formula; war to create debt and dependency.

- If

they couldn't get their central bank any other way, America

could be brought to its knees by plunging it into a civil war,

just as they had done in 1812 after the First Bank of the

United States was not rechartered.

.jpg)

Alexander Gardner, Public domain, via Wikimedia Commons

Abraham Lincoln -

16th president |

- One month after the

inauguration of Abraham Lincoln (1809=1865), the first shots of the

American Civil War were fired at Fort Sumpter in South

Carolina, on April 12, 1861.

- Certainly slavery was a

cause for the war, but not the primary cause.

- Lincoln

knew that the economy of the South depended upon slavery and

so before the Civil War, he had no intention of eliminating

it.

- Lincoln had put it this way in his inaugural address

only one month earlier.

|

I have no purpose, directly or indirectly, to

interfere with the institution of slavery in the

states where it now exists. I believe I have no lawful

right to do so, and I have no inclination to do so.

(Abraham Lincoln)

|

Fort Sumpter |

- Even after the first shots were fired at Fort Sumpter,

Lincoln continued to insist that the Civil War was not about

the issue of slavery.

- He stated that his paramount

objective was to save the Union, and that is was not either to

save or destroy slavery.

- He felt that if he could save

the Union without freeing any slave, he would do that.

-

But what was the Civil War all about, there were many factors

at play.

- Northern industrialists had used protective

tariffs to prevent the Southern states from buying cheaper

European goods.

- Europe retaliated by stopping cotton

imports from the South.

Deep south |

- As a result, the southern states were in a double

financial bind.

- They were forced to pay more for most of

the necessities of life, while their income from cotton

exports plummeted.

- The South was angry, but there were

other factors at work.

- First off, the money changers were

still stung by America's withdrawal from their control 25

years earlier.

- Since that time, America's wildcat economy

had made the nation rich, a bad example for the rest of the

world.

- The central bankers now saw an opportunity to

split the rich new nation, to divide and conquer by war.

-

Was this just some sort of wild conspiracy theory at the time?

- A well placed observer named Otto von Bismarck, Chancellor

of Germany, the man who united the German states a few years

later had entered the debate.

|

The division of the United States into federations

of equal force was decided long before the Civil War

by the high financial powers of Europe. These bankers

were afraid tht the United States, if they remained as

one block, and as one nation, would attain economic

and financial independence which would upset their

financial control over the world. (Otto von

Bismarck)

|

War moves |

- Within months after the first shots were fired at Fort

Sumpter, the central bankers loaned Napoleon III of France,

the nephew of Napoleon who tangled at Waterloo, 210 million

francs to seize Mexico and station troops along the southern

border of the U.S., taking advantage of their war to violate

the Monroe Doctrine and return Mexico to colonial

rule.

- No matter what the outcome of the Civil War, a

weakened America, heavily indebted to the money changers,

would open up Central and South America once again to European

colonization and domination.

- The very thing America's Monroe Doctrine

had forbade in 1823.

- At the same time, Great Britain

moved 11,000 troops into Canada and positioned them menacingly

along America's northern border.

|

The Monroe Doctrine, proclaimed by President James Monroe in 1823, is a foundational U.S. foreign policy that warned European powers against further colonization or interference in the Americas, asserting the Western Hemisphere as a separate sphere of influence for the U.S. and its newly independent neighbors, and pledging U.S. non-interference in European affairs in return, becoming a cornerstone for asserting American hegemony and intervention in Latin America. (Assistant)

|

British fleet |

- The British fleet went to war alert should their quick

intervention be called for.

- Lincoln knew he was in a

double bind and that's why he agonized over the fate of the

Union.

- There was a lot more to it than just differences

between the North and South and that's why his emphasis was

always on Union and not merely the defeat of the South.

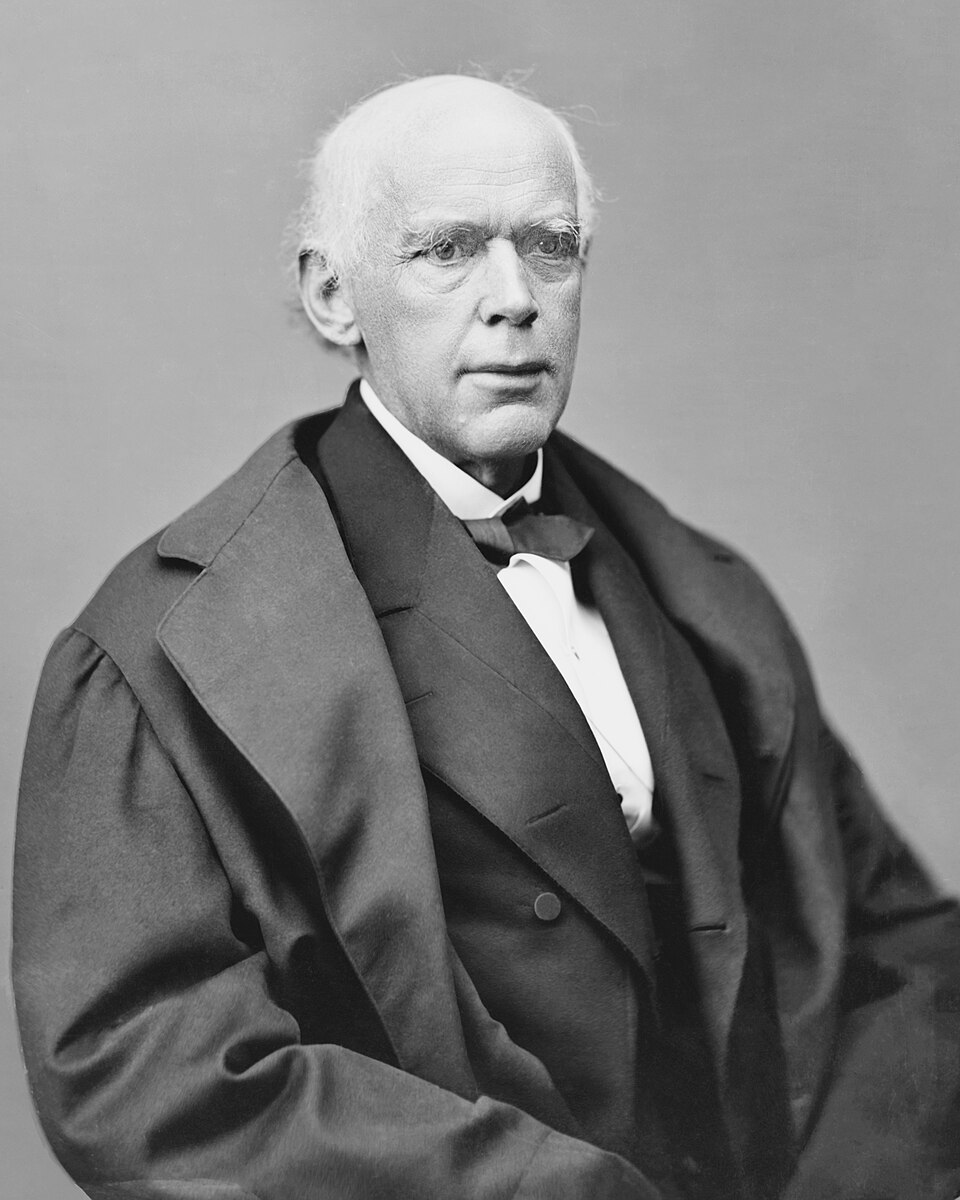

Public domain, via Wikimedia Commons

Salmon Portland Chase |

-

But Lincoln needed money to win and in 1861, Lincoln and his

Secretary of Treasury, Salmon P, Chase, went to New York to

apply for the necessary loans.

- The money changers,

anxious to see the Union fail, offered loans at 24-36%

interest.

- Lincoln told them thanks, but no thanks and

returned to Washington.

|

Salmon P. Chase was a significant rival to Abraham Lincoln, primarily for the 1860 Republican presidential nomination, but he became a vital ally by serving as Lincoln's Secretary of the Treasury during the Civil War, raising crucial funds and advocating for emancipation; later, Lincoln appointed Chase as Chief Justice of the U.S. Supreme Court, where he presided over President Andrew Johnson's impeachment trial and continued his influential career. (Assistant)

|

Public domain, via Wikimedia Commons

Edmund Dick Taylor |

- Abraham Lincoln sent for an old friend, Colonel Edmund Dick Taylor (1804-1891)

who was an American businessman, politician, and soldier from Illinois.

- Lincoln put Taylor on the problem of financing the war.

-

Taylor is remembered as the first person to suggest that the United States should issue paper currency ('Greenbacks') during the American Civil War.

- During one meeting, Lincoln asked Taylor what he discovered

and Taylor advised getting Congress to authorie full legal

tender treasury notes.

- When Lincoln questioned whether

the American people would accept the notes Taylor told him

that the people, or anyone else would not have any choice in

the matter.

|

Why, Lincoln, that is easy; just get Congress to

pass a bill authorizing the printing of full legal

tender treasury notes, and pay your soldiers with them

and go ahead and win your war with them also. (Colonel

Taylor)

|

National Numismatic Collection,National Museum of American History, Public domain, via Wikimedia Commons

Image of one dollar "Greenback" first issued in 1862 |

- Taylor believed that if Lincoln made them full legal

tender, they would have the full sanction of the government

and would be just as good as any money because Congress would

have given that express right of the Constitution.

- That's exactly what Lincoln proceeded to do in 1862-63 he

printed up $450 million of the new bills.

- In order to

distinquish them from other bank notes in circulation, he

printed them in green ink on the backside which is why they

were called 'Greenbacks.'

- With this new money, Lincoln

paid the troops and bought their supplies.

- During the

course of the war, nearly $450 million worth of Greenbacks

were printed at no interest to the federal government.

Consumers |

- Lincoln understood who was really pulling the strings

and what was at stake for the American people.

- He

explained his rationale by saying he believed that the

government should create, issue and circulate all the currency

and credit needed to satisfy the spending power of the

government and the buying power of the consumers.

|

The privilege of creating and issuing money is not

only the supreme prerogative of Government, but it is

the Government's greatest creative opportunity. By the

adoption of these principles, the taxpayers wil be

saved immense sums of interest. Money will cease to be

master and become the servant of humanity. (Abraham

Lincoln)

|

Central bank |

- An article in the London Times explained the

central bankers attitude towards Lincoln's Greenbacks.

-

The newspaper described his actions as a 'mischievous

financial policy' with origins in North America.

- It went

on to say that the Government would furnish its own money

without cost and pay off debts and it would become prosperous

without precedent in world history.

- The editor went on to

say that, 'The brains, and wealth of all countries will go to

North America and that America must be destroyed or it will

destroy every monarchy on the globe.'

- What a bunch of

greedy central banker bunk and very telling about who owned

the press in Britain, the Rothschilds.

Gathering for war |

- The bankers scheme was effective, so effective that the

next year, 1863, with federal and confederate troops

beginning to amass for the decisive battle of the Civil War.

- At the same time, the treasury was in need of more

Congressional authority to issue more Greenbacks, Lincoln

allowed the bankers to push through, the National Bank Acts

of 1863 and 1864.

- These acts created a dual currency

system that linked bank notes to government bonds (debt) and

aimed to standardize paper money, however, Greenbacks remained

legal tender for a time.

-

It designated how new national banks would operate under a virtual

tax-free status and collectively have the exclusive monopoly

power to create the new form of currency, banknotes.

-

For years, both Greenbacks and National Bank Notes circulated, creating confusion, but the goal was to phase out the less stable state bank notes and integrate federal debt into the currency.

- But most importantly, from this point on,

the entire U.S. money supply would be created out of debt by

bankers buying U.S. government bonds and issuing them for

reserves for banknotes.

|

The National Bank Acts (1863, amended 1864) created a system of federally chartered banks to provide a stable, uniform national currency, replacing chaotic state banknotes, and to finance the Civil War by selling government bonds, establishing the OCC and a framework for national banks that persists today, though modified by later laws like the Federal Reserve Act. These acts mandated banks hold U.S. bonds to issue currency, creating a federal banking system, but also led to complex preemption rules for state laws, a topic still debated in courts. (Assistant)

|

.jpg)

Public domain, via Wikimedia Commons

Czar Alexander II |

- As historian John Kenneth Gailbraith explained it, 'In

numerous years following the war, the government ran a heavy

surplus, however, it could not pay off its debt, retire its

securities, because to do so meant there would be no bonds to

back the national banknotes; to pay off the debt was to

destroy.'

- Later in 1863, Lincoln got some unexpected help

from Czar Alexander II of Russia.

- Czar Alexander, like

Bismarck and Germany, knew what the international money

changers were up to and had steadfastly refused to allow them

to set up a central bank in Russia.

Headquarters |

- If America survived, and was able to remain out of their

clutches, the Czar's position would remain secure.

-

However, if the bankers were successful at dividing America

and giving the pieces back to Great Britain and France, both

nations under control of their central banks, eventually would

threaten Russia again.

- The Czar gave orders that if

either England or France actively intervened and gave aide to

the South, Russia would consider such action as a declaration

of war.

- He did the same with part of his Pacific fleet

and sent them to port in San Francisco.

- Lincoln was

re-elected the next year in 1864, and had he lived, he would

surely have killed the national bank's money monopoly

extracted from him during the war.

|

Abe Lincoln

as Jefferson Davis |

Abraham Lincoln

1809-1865

2/12 4/15 |

Jefferson F. Davis

1808-1889

6/3

12/6 |

|

|

|

16th president |

-

So far, we know that Lincoln did not really intend to end

slavery and that was his election promise, and that he was the

one who allowed the bankers to push through the National Bank Act.

- But you have to wonder what they were really up to?

Big government |

- When you realize that Alexander Hamilton, who was a

Founding Father, was really working for the bankers and wanted

a private central bank as well as a centralized federal

government instead of states rights.

- And he was not the

only one.

- We sometimes mistake all their lofty words as

something good but are they really, especially since we know

all our history has been rigged?

- Additionally, how

Founding Fathers such as Thomas Jefferson who lamented about

not being able to add amendments to the Constitution, when he

worked on drafting it to make it so.

- Then you wonder how

in the world these men completely left any provisions about

our currency or its control out of the document!!

- Because

that's really a red flag, it's rather hazy and all seems very

handy (for them)?

War machine |

- On

November 21, 1864, Lincoln wrote a friend that, 'The money

power preys upon the nation in times of peace and conspires

against it in times of adversity.'

- Shortly before Lincoln

was murdered, his former Secretary of Treasury, Salmon P.

Chase, bemoaned his role in helping secure the passage of the

National Bank Act only one year earlier.

-

Chase remarked that his agency in passing the act was the

greatest financial mistake of his life because it built a

monopoly which affected every interest in the country.

|

It is more despotic than monarchy, more insolent

than autocracy, more selfish than bureaucracy. (Abraham

Lincoln)

|

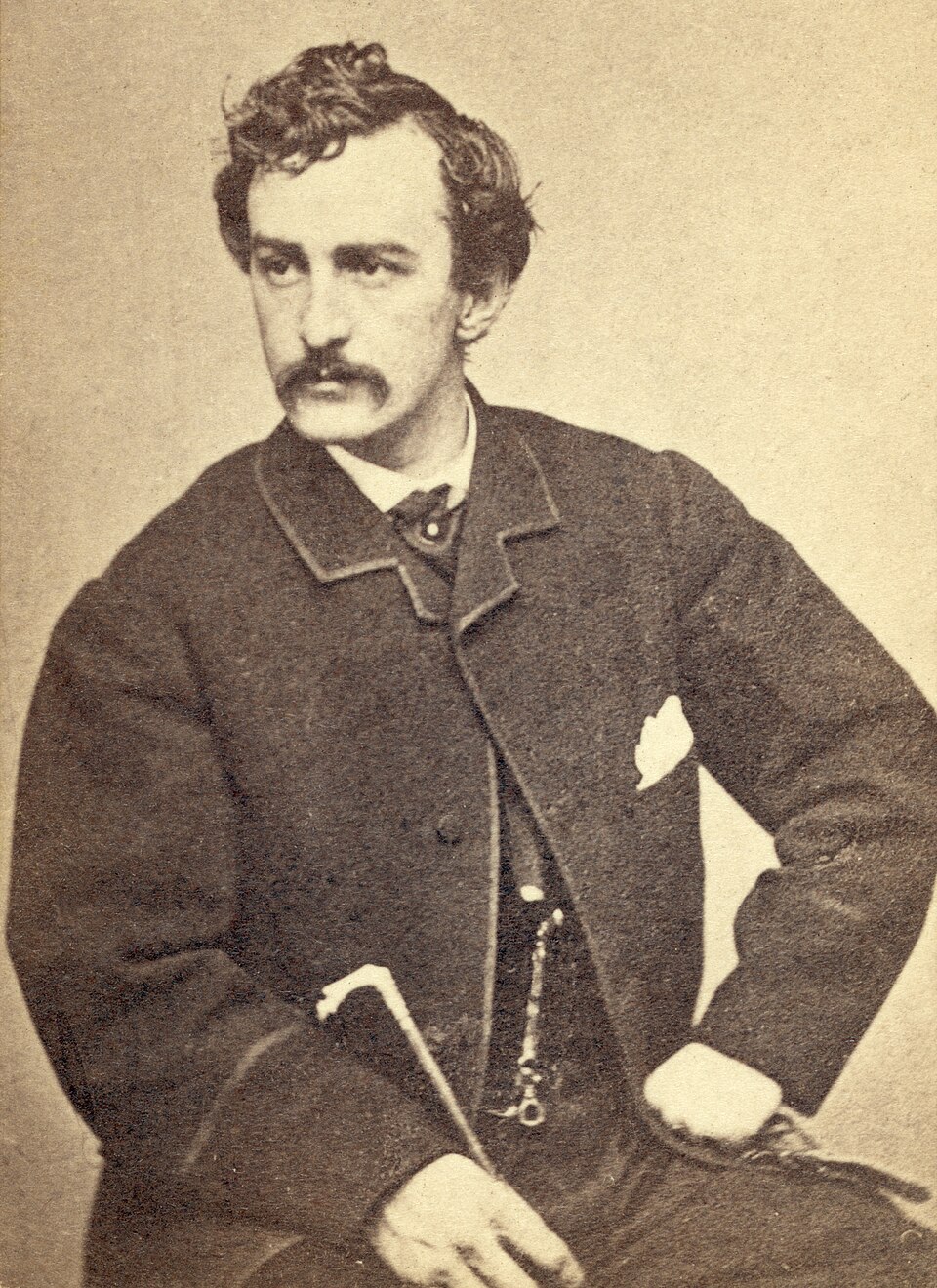

Alexander Gardner, Public domain, via Wikimedia Commons

John Wilkes

Booth |

- On April 14, 1865, a short 41 days after Lincoln's 2nd

inauguration, and just 5 days after Lee surrendered to Grant

at Appomattox, Lincoln was assassinated by John Wilkes Booth

at Ford's Theater in Washington.

- Ottot von Bismarck well

understood the money changers plan.

|

The death of Lincoln was a disaster for

Christendom. There was no man in the United States

great enough to wear his boots... I fear that foreign

bankers with their craftiness and tortuous tricks will

entirely control the exuberant riches of America, and

use it systematically to corrupt modern civilization.

They will not hesitate to plunge the whole of

Christendom into war and chaos in order that the earth

should become their inheritance. (Otto

von Bismarck)

|

|

Elon Musk as

John Wilkes Booth |

Elon Reeve Musk

1971

6/28 |

John Wilkes Booth

1838-1865

5/10 4/26 |

|

|

|

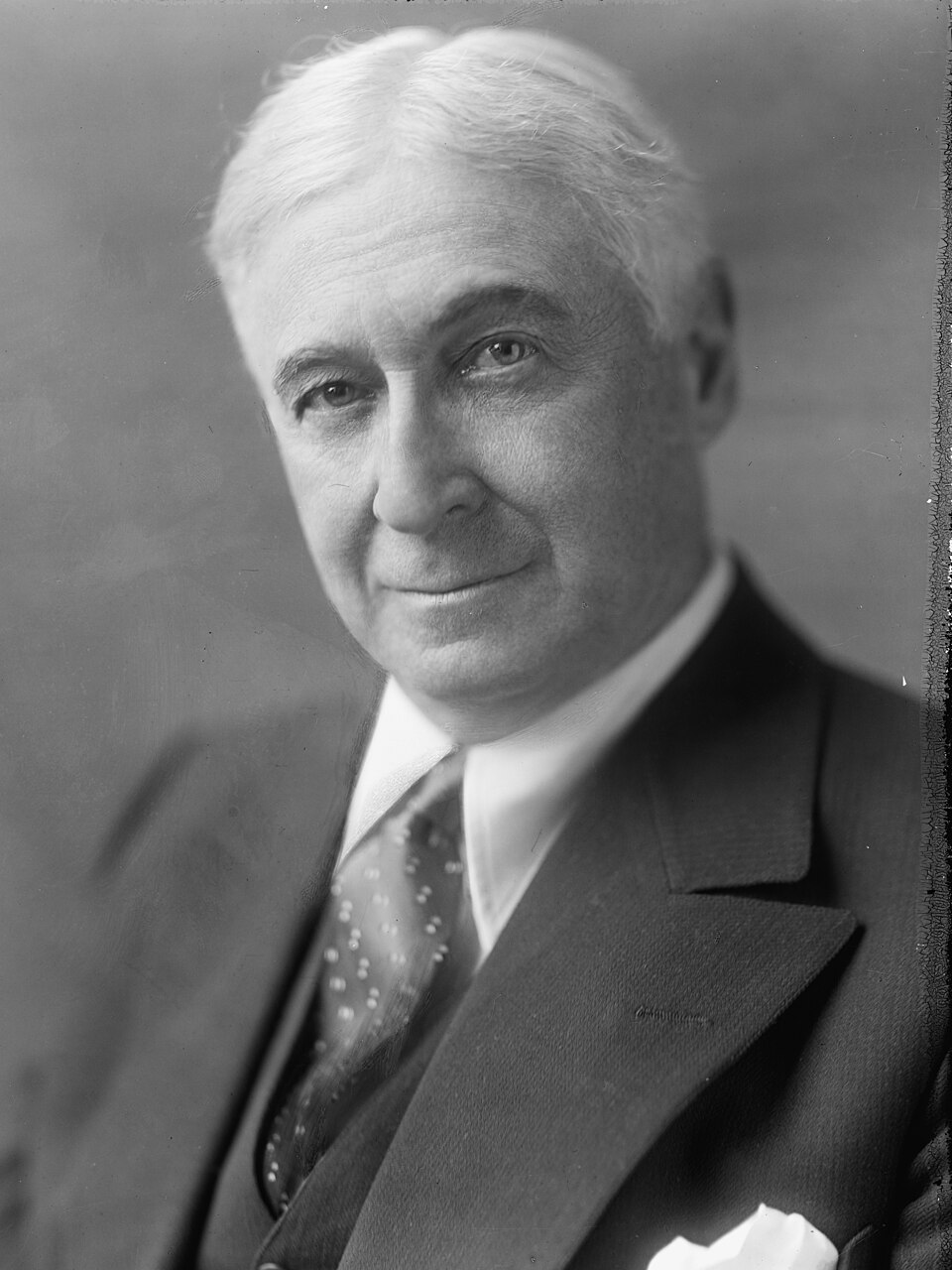

Mercenary |

- Allegations that international bankers were responsible for

Lincoln't assassination surfaced in Canada 70 years later in

1934.

- This happened when Gerald G. 'Gerry' McGeer

(1888-1947), a popular and well-respected Canadian attorney,

revealed a stunning charge in a 5-hour speech before the

Canadian House of Commons blasting Canada's debt-based money

system.

- This happened in 1934, the height of the Great

Depression, which was ravaging Canada as well.

Public domain, via

Wikimedia Commons

Gerry McGeer |

- McGeer had obtained evidence deleted from the public

record provided to him by Secret Service agents at the trial

of John Wilkes Booth after Booth's death.

- The evidence

showed that Booth was a mercenary working for the

international bankers.

- According to an article in the

Vancouver Sun on May 2, 1934, that Lincoln, the martyred

emancipator of the slaves, was assassinated through the

machinations of a group representative of the international

bankers who feared the U.S. president's national credit

ambitions.

- Apparently the plan was hatched in Toronto and

Montreal.

|

Gerry McGeer as

John Wilkes Booth |

Gerald G. 'Gerry' McGeer

1888-1947

1/6

8/11

Journalist |

John Wilkes Booth

1838-1865

5/10 4/26

Actor |

|

|

|

Mayor |

- Always playing both sides of the game.

|

Elon Musk as

Gerry McGeer |

Elon Reeve Musk

1971

6/28 |

Gerald G. 'Gerry' McGeer

1888-1947

1/6

8/11

Journalist |

|

|

|

Canadian gold miner |

-

Mercenary |

- There was only one group in the world at that time who

had any reason to desire the death of Lincoln, they were the

men opposed to his national currency program.

- They had

fought Lincoln through the whole Civil War on his policy of

Greenback currency.

- Interestingly, McGeer claimed that

Lincoln was assassinated not only because of international

bankers wanted to establish a central bank in America, but

because they also wanted to base America's currency on gold.

- That is, gold they controlled, in other words, put America

on a gold standard.

- Lincoln had done just the opposite by

issuing U.S. notes, Greenbacks, which were based purely on the

good faith and credit of the U.S.

|

They were the men interested in the establishment

of a gold standard and the right of

the bankers to manage the currency and credit of every

nation in the world. With Lincoln out of the way, they

were able to proceed with that plan and did proceed

with it in the United States. (Gerry

McGeer)

|

Bank machinations |

- Obviously, for many decades following Lincoln's

assassination, central bankers were very involved in creating

currency backed by gold.

- With Lincoln out of the way, the

money changers next objective was to gain complete control

over America's money, however, this was no easy task.

- As

the American West opened, silver was discovered in huge

quantities and on top of that, Lincoln's Greenbacks were

generally popular.

Established

institution |

- Despite the European bankers deliberate attacks on

Greenbacks, they continued to circulate in the U.S.

- In

fact, until not too long ago, according to historian W. Cleon

Skousen, 'Right after the Civil War there was considerable

talk about reviving Lincoln's brief experiment with the

Constitutional monetary system.'

- Had not the European

money-trust intervened, it would have no doubt become an

established institution.

- It is clear that the concept

of America printing her own debt-free currency, sent shock

waves throughout the European central banking elite.

- They

watched with horror as Americans clamored for more Greenbacks.

Support grew |

- They may have killed Lincoln, but support for his

monetary ideas grew but it's unfortunate that he turned the

banks over to the central bankers.

- On April 12, 1866,

nearly one year to the day of Lincoln's demise, Congress went

to work at the bidding of the European Central banking

interests.

- They passed the Contraction Act,

authorizing the Secretary of the Treasury to begin to retire

some of the Greenbacks in circulation and thereby contract the

money supply.

Hardship after the

Civil War |

- Authors Theodore R. Thorne and Richard F. Warner

explained the results of the money contraction in their

classic book on the subject, The Truth in Money Book.

- They believed that the hard times after the Civil War could

have been avoided if the Greenback legislation had continued

as Lincoln had intended.

- Instead, there were a series of

money panics, what we call recessions, which put pressure on

Congress to enact legislation to place the banking system

under centralized control.

Master masons |

- Eventually, the Federal Reserve Act was passed on

December 23, 1913, when most of Congress was away on holiday

break.

- The money changers wanted 2 things; the

reinstitution of a central bank under their exclusive control,

and an American currency backed by gold.

- Their strategy

was twofold, first of all, cause a series of panics to try to

convince the American people that only centralized control of

the money supply could provide economic stability.

-

Secondly, remove so much money from the system that most

Americans would be so desperately poor that they wouldn't

care, or they would be too weak to oppose the bankers.

Bow down to the

banker |

- In 1866, there was $1.8 billion in currency in

circulation in the U.S., or about $50.46 per capita.

- In

1867 alone, about $500 million was removed from the U.S. money

supply and 10 years later in 1876, America's money supply was

reduced to only $600 million.

- In other words, a full

two-thirds of America's money had been called in by the

bankers.

- This left only $14.60 per capita remaining in

circulation and 10 years later, the money supply had been

reduced to only $400 million, even though the population had

boomed.

- The result was that only $6.67 (666) per capita

remained in circulation, a 760% loss in buying power over 20

years.

Recessions and

depressions |

- Now can you see why you feel so poor and our economy

seems to be always in a recession, it's maddening?

-

Especially when you figure out who's holding all our money,

greedy overpaid

Jewish bankers and thieves.

- Today, economists try to sell the idea

that recessions and depressions are a 'natural' part of

something they call the business cycle.

- But that's a

massive lie.

- The truth is, our money supply is

manipulated now just as it was before and after the Civil War.

Sent to bribe

Americans |

- How did this happen, how did money become so scarce?

-

Simple, bank loans were called in, and no new loans were

given.

- In addition, silver coins were melted down.

-

In 1872, a man named Ernest Seyd was given £100,000, about

$500,000 by the Bank of England and sent to America to bribe

necessary congressmen to get silver demonetized.

- Seyd was

told if that was not sufficient, he could draw an additional

£100,000, or as much as necessary.

- The next year,

Congress passed the Coinage Act of 1873 and the

minting of silver dollars abruptly stopped.

Gold Standard |

- Within 8 years after Lincoln's death, silver was

demonetized and the old standard money system set up in the

United States.

- The Coinage Act of 1873 officially ended the U.S. policy of bimetallism (using both gold and silver) by demonetizing silver and effectively putting the U.S. on a gold standard, a move critics called the

'Crime of '73.'

- Representative, Samuel Hooper, who

introduced the bill in the House acknowledged that Ernest Seyd

drafted the legislation.

- This act stopped the free coinage of silver dollars, shifting the monetary system away from silver, which caused economic shifts and political battles.

- Not since Lincoln has the U.S. issued

debt-free U.S. notes.

|

The U.S. formally adopted the gold standard with

the Gold Standard Act of 1900, linking paper currency

directly to gold reserves for stability, but the

country had moved towards it earlier, particularly

after the Coinage Act of 1873 ended bimetallism and

following the Civil War. This system allowed paper

money to be redeemed for gold and lasted until

President Roosevelt suspended gold convertibility for

domestic use in 1933, fully ending the link in 1971. (Assistant)

|

Red sealed noted Red sealed noted/tr>

|

- These red sealed bills, which were

issued in 1963, were not a new issue from President John F.

Kennedy, but merely the old Greenbacks reissued, year after

year.

- Kennedy issued a 1963 directive through Executive

Order 11110 that delegated authority to the Treasury Secretary

to issue silver certificates against silver builion.

- This

was a technical move to help transition away from

silver-backed currency after Congress repealed the Silver

Purchase Act.

Cincinnati Commercial

Gazette - November 14, 1892 |

- The "red sealed note JFK gold standard" refers to a popular theory linking President Kennedy's assassination to his alleged attempt to challenge the Federal Reserve by issuing silver-backed

U.S. Notes (with red seals) instead of Federal Reserve Notes.

- This was supposedly to return to a gold standard or at least a silver-backed system, enabling silver certificates, thus threatening bankers, though the order actually just transferred some silver certificate authority and notes weren't backed by gold.

Silver |

-

Why was silver bad for the bankers, and silver good?

-

Simple, because silver was plentiful in the U.S. and very hard

to control, while gold was, and always has been scarce.

-

Silver has historically been 15 times more plentiful than

gold.

-

In 1994, Congress pushed through the Riegle-Neal

Interstate Act to allow banks to operate across state

lines.

- This caused a flurry of bank failures and branches

were purchased by larger bank systems such as Wells Fargo in

the 1990s.

|

The Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994, a landmark US law that allowed banks to operate and open branches across state lines, ending restrictive interstate banking bans, and promoting a unified national banking system after years of fragmented state laws. (Gerry

McGeer)

|

Silver scheme |

- It gets even worse, in 1874, Ernest Seyd admitted who

was behind the scheme.

- Seyd claimed that he went to

America in 1872, authorized to secure the passage of a bill

demonetizing silver and it was in the interest of those he

represented, the governors of the Bank of England, to get it

done.

- By 1873, gold coins were the only form of coin

money.

- But the contest over control of America's money

was not yet over.

- Only 3 years later, in 1876, with

one-third of America's workforce unemployed, the population

was growing restless.

Fall of an empire |

- American's were clamoring for a return to the Greenback

money system of Abraham Lincoln, or a return to silver money,

anything that would make money more plentiful.

- That year,

Congress created the U.S. Silver Commission to study the

problem.

- Their report clearly blamed the monetary

contraction on the national bankers.

- The report is

interesting because it compares the deliberate money

contraction by the national bankers after the Civil War to the

fall of the Roman Empire.

- Despite the report from the

Silver Commission, Congress took no action.

|

The disaster of the Dark Ages was caused by decreasing money and falling prices, without money, civilization could not have had a beginning and with a diminishing supply, it must lanquish, and unless relieved, finally perish. At the Christian era the metallic money of the Roman Empire amounted to $1.8 trillion. By the end of the 15th-century it had shrunk to less than $200 million. History records no other such disastrous transition as that from the Roman Empire. (U.S.

Silver Commission)

|

Riot |

- That next year, 1877, riots broke out from Pittsburgh to

Chicago and the torches of starving vandals lit up the sky.

- The bankers huddled to decide what to do and they decided to

hang on.

- Now that they were back in control to a certain

extent, they were not about to give it up.

- At the meeting

of the American Bankers Association (ABA) that year, they

urged their membership to do everything in their power to put

down the notion to return to Greenbacks.

- The ABA

secretary, James Buell, authored a letter to the members which

blantantly called on the banks to subvert not only Congress,

but the press.

|

It is advisable to do all in your power to sustain

such prominent daily and weekly newspapers, especially

the Agricultural and Religious press, as will oppose

the greenback issue of paper money and that you will

also withhold patronage from all applicants who are

not willing to oppose the government issue of money.

To repeal the Act creating bank notes, or to restore

to circulation the government issue of money will be

to provide the people with money and will therefore

seriously affect our individual profits as bankers and

lenders. (James Buell, ABA)

|

Mounted |

- The ABA went on and urged their members to 'see your

congressmen at once and engage him to support our interests

that we may control legislation.'

- As political pressure

mounted in Congress for change, the press tried to turn the

American people away from the truth.

- The New York

Tribune put it this way on January 10, 1878, 'The capital

of the country is organized at last and we will see whether

Congress will dare to fly in its face.'

- But it didn't

work entirely, on February 28, 1878, Congress passed the

Sherman Law, allowing the minting of a limited number of

silver dollars, ending the 5-year hiatus.

Depression finally

over |

- The Sherman Law did not end gold backing of the

currency, however, nor did it completely free silver.

- Previous to 1873,

anyone who brought silver to the U.S. mint could have it

struck into the silver dollars free of charge.

- This was no longer

allowed, but at least some money began to flow back into the

economy.

- With no further threat to their control, the

bankers loosened up on loans and the post Civil War depression

was finally over.

|

The Sherman Silver Purchase Act of 1890 was a U.S. law requiring the Treasury to buy large amounts of silver (4.5 million ounces monthly) to support struggling farmers and miners during deflation, issuing notes redeemable in gold or silver, but it failed, worsening economic instability and contributing to the Panic of 1893, leading to its repeal in 1893 by President Grover Cleveland, who favored the gold standard. (Assistant)

|

Brady-Handy Photograph Collection., Public domain, via Wikimedia Commons

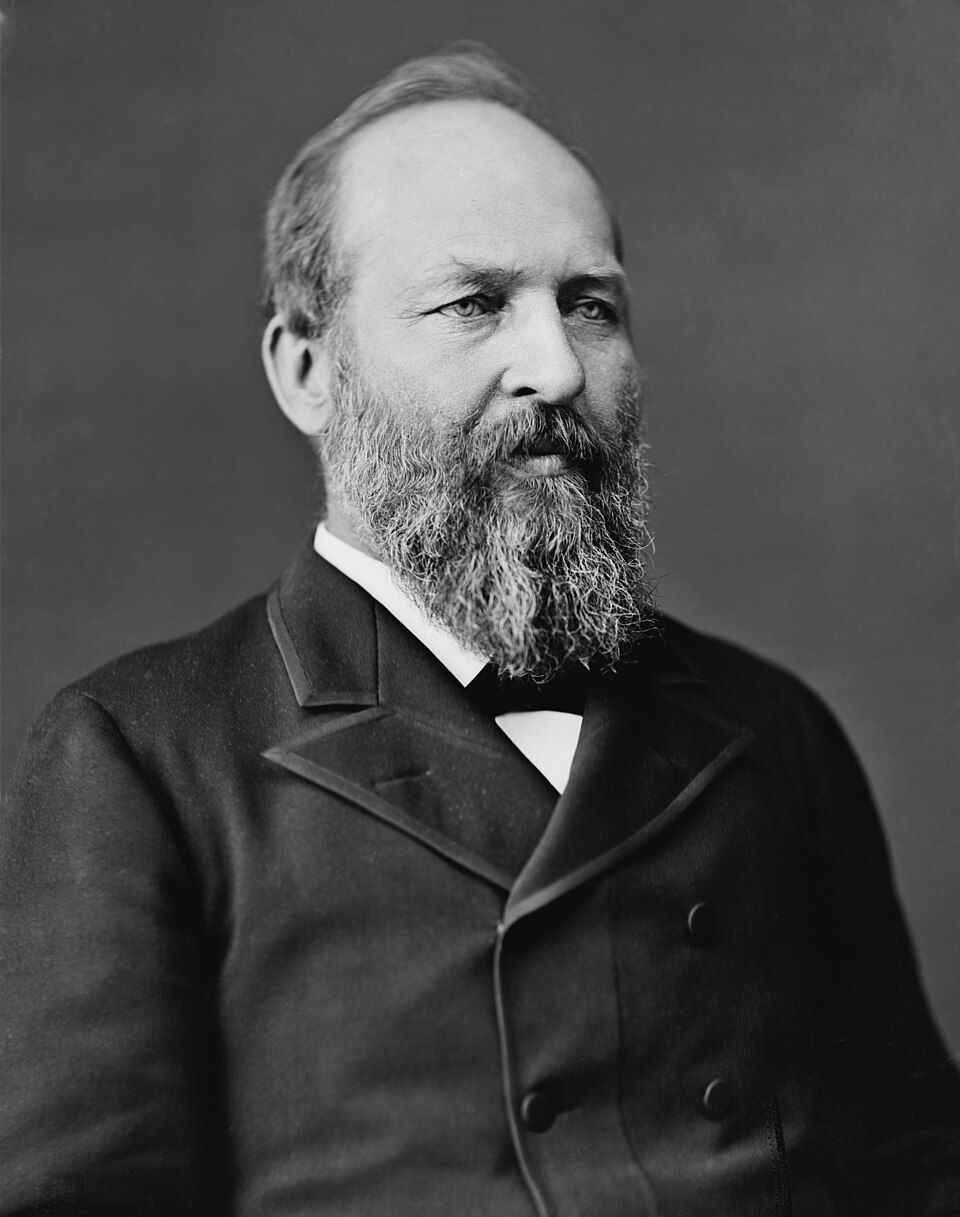

President James

Garfield |

- Three years later, in 1880, Republican James Garfield (1831-1881) was elected.

- Garfield understood how the economy was being manipulated.

- As a congressman, he had been chairman of the Appropriations

Committee and was a member of banking and currency.

|

JD Vance as

James Garfield |

James David Vance

(ne James Donald Bowman)

1984

8/2

Trump's vice president |

James Abram Garfield

1831-1881

11/19 9/19

20th president |

|

|

|

Bow man |

- After inauguration, Garfield slammed the money changers

publicly in 1881.

- Unfortunately, within a few weeks of

making this statement, on July 2, 1881, Garfield was

assassinated.

|

Whoever controls the volume of money in any

country is absolute master of all industry and

commerce. And when you realize that the entire system

is very easily controlled, one way or another, by a

few powerful men at the top, you will not have to be

told how periods of inflation and depression

originate. (James Garfield)

|

Free silver |

- The money changers were gathering strength fast and they

began a periodic fleecing of the flock, as they called it, by

creating economic booms followed by further depressions, so

they could buy up thousands of homes and farms for pennies on

the dollar.

- In `1891, the money changers prepared to take

the American economy down again.

- Their methods and

motives were laid out with shocking clarity in a memo sent out

by the American Banking Association, an organization in which

most bankers were members.

- Notice that this memo called

for bankers to create a depression on a certain date, 3 years

in the future.

- These depressions could be controlled

because America was on the gold money standard and since gold

is scarce, it's one of the easiest commodities to manipulate.

|

On September 1,1894, we will not renew our loans

under any consideration. On September 1st we will

demand our money. We will foreclose and become

morgagees in possession. We can take two-thirds of the

farms west of the Mississippi, and thousands of them

east of the Mississippi as well, at our own price..

Then the farmers will become tenants as in England.

(ABA, Congressional Record April 29, 1913)

|

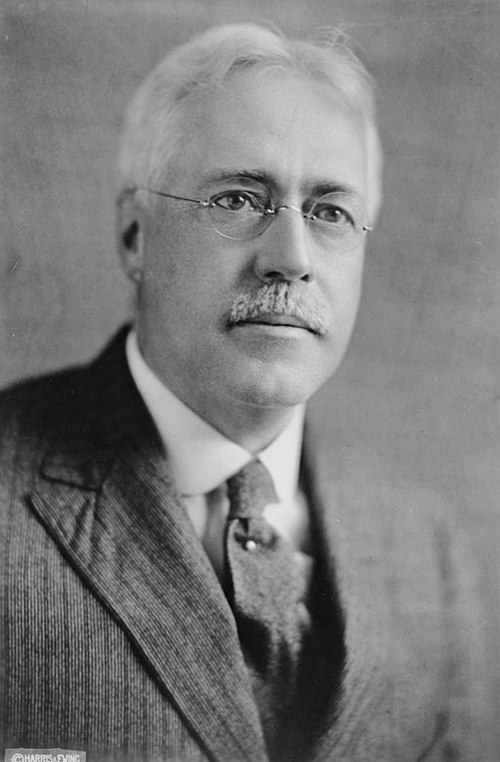

Harris & Ewing, photographer, Public domain, via Wikimedia Commons

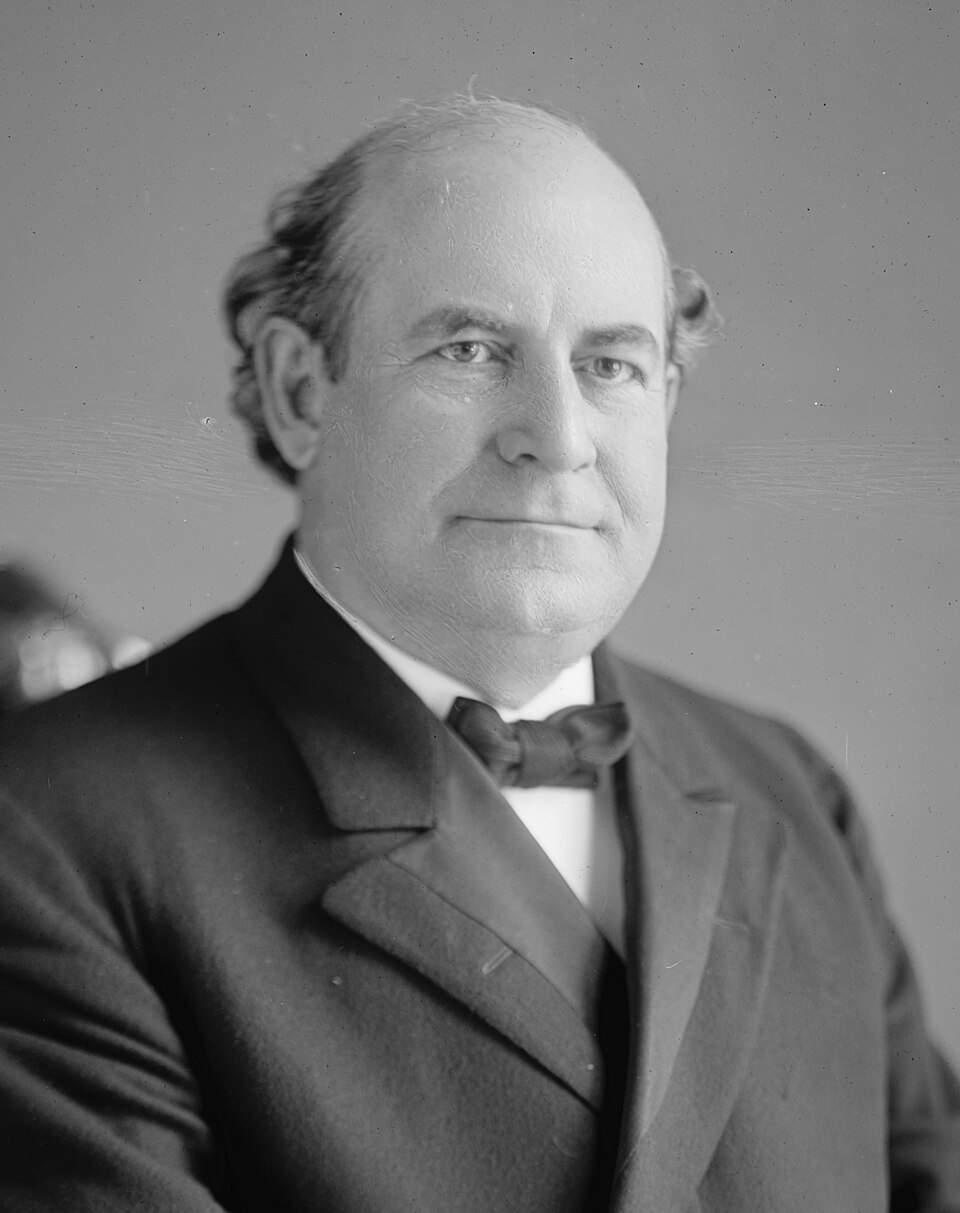

William James Bryan |

- People wanted silver money legalized again so they could

escape the stranglehold the money changers had on gold money.

- Americans wanted silver money reinstated, reversing Ernest

Seyd's act of 1873.

- By 1896, the issue of more silver

money had become the central issue in the presidential

campaign.

- William James Bryan (1860-1925), a Senator from

Nebraska, ran for president as a Democrat on the free silver

issue in 1896.

- At the Democrat National Convention in

Chicago, he made an emotional speech which won him the

nomination entitled, 'Crown of Thorns and Cross of Gold.'

-

Though Bryan was only 36 years old at the time, this speech is

widely regarded as the most famous oration ever made before a

political convention.

|

We will answer their demand for a gold standard by

saying to them; You shall not press down upon the brow

of labor this crown of thorns, you shall not crucity

mankind upon a cross of gold.

(William James Bryan)

|

.jpg)

Public domain, via Wikimedia Commons

William

McKinley - 25th

president |

- The bankers lavishly supported the Republican candidate,

William McKinley (1843-1901), who favored the gold standard.

-

The resulting contest was among the most fiercely contested

presidential races in American history.

- Bryan made over

600 speeches in 27 states, and the McKinley got manufacturers

and industrialists to inform their employees that if Bryan

were elected, all factories and plants would close and there

would be no work.

- The ruse succeeded, McKinley beat Bryan

by a small margin.

- Bryan ran again in 1900 and 1908, but

fell short each time.

|

Winston

Churchill as William

McKinley |

Winston Leonard Spencer Churchill

1874-1965

10/14

9/10

|

William McKinley

1843-1901

1/29 9/14

25th president |

|

|

|

Ruse |

- William McKinley was assassinated on September 6, 1901, in

the Temple of Music on the grounds of the Pan-American

Exposition in Buffalo, New York, 6 months into his 2nd term.

- McKinley died on September 14 of gangrene caused by the wounds.

- He was the 3rd American president to be assassinated, following Abraham Lincoln in 1865 and James A. Garfield in 1881.

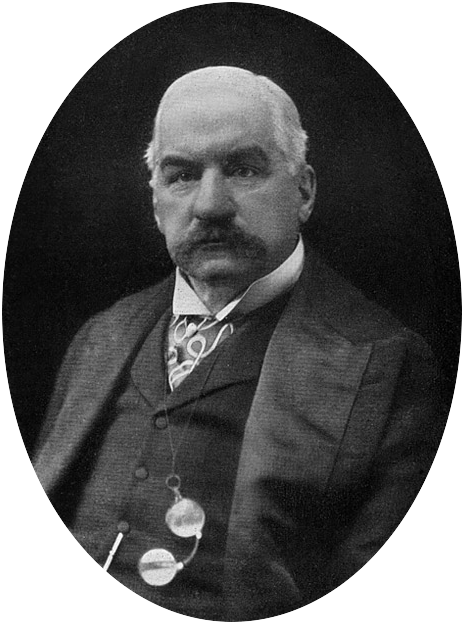

Beao, Public domain, via Wikimedia Commons

John Pierpont Morgan |

- John Pierpont Morgan (1837-1913) was an American financier and investment banker who dominated corporate finance on Wall Street throughout the Gilded Age and Progressive Era.

- Now it was time for the money changers to get back to

the business of a new private central bank for America.

-

During the early 1900s, men like JP Morgan led the charge.

- One final panic would be required to focus the nation's

attention on the supposed need for a central bank.

- The

rationale was that only a central bank could prevent bank

failures.

|

Donald Trump as J.P. Morgan |

|

|

Donald John Trump

1946

6/14

45th/47th president |

John Pierpont Morgan

1837-1913

4/17

3/31

Banker |

|

|

|

Titanic |

- Morgan was clearly the most powerful banker in America

and a suspected agent for the Rothschild's.

- He had helped

finance John D. Rockefeller's Standard Oil Empire.

- Morgan

had also helped finance the monopolies of Edward Harriman in

railroad, and Andrew Carnegie in steel, and many others in

numerous industries.

- On top of that, Morgan's father,

Junius Morgan, had been America's financial agent to the

British.

- After his father's death, J.P. Morgan took on a

British partner, Edward Grenfell (1870-1941), a long time

director of the Bank of England.

Public domain, via

Wikimedia Commons

Theodore Roosevelt

- 26th president |

- In fact, upon Morgan's death, his estate contained

only a few million dollars.

- The bulk of the securities

most people thought he owned were in fact owned by others.

- In 1902, President Theodore Roosevelt (1858-1919) allegedly

went after Morgan and his friends by using the Sherman

Antitrust Act to try to break up their industrial

monopolies.

- Actually, Roosevelt did very little to

interfere in the growing monopolization of American industry

by the bankers and their surrogates.

- For example,

Roosevelt supposedly broke up Rockefeller's Standard Oil

monopoly, however, it wasn't really broken at all, it was

merely divided into 7 corporations, all still controlled by

the Rockefeller's.

- The public was aware of this thanks to

political cartoonists like Thomas Nast who referred to the

bankers as the 'money trust.'

|

The Sherman Antitrust Act of 1890 is the foundational U.S. law prohibiting anti-competitive practices, outlawing monopolies and conspiracies in restraint of trade to ensure free competition in interstate commerce, criminalizing price-fixing, bid-rigging, and monopolization, and serving as a cornerstone of antitrust enforcement against large trusts like Standard Oil to protect consumers and workers. (Assistant)

|

|

J.P. Morgan as Theodore Roosevelt |

|

|

John Pierpont Morgan

1837-1913

4/17

3/31

Banker |

Theodore Roosevelt Jr.

1858-1919

10/27

1/6

26th president |

|

|

|

33rd

degree square deal |

- Teddy Roosevelt previously was involved in New York politics, including serving as the state's 33rd governor for two years.

- He served as the 25th vice president under President William McKinley for six months in 1901, assuming the presidency after McKinley's assassination.

- How amazing.

Triangled |

- By 1907, the year after Teddy Roosevelt's re-election,

J.P. Morgan decided it was time to try for a central bank

again.

- Using their combined financial muscle, Morgan and

his friends were secretly able to crash the stock market.

-

As a result, thousands of banks were vastly overextended.

-

Some had reserves of less than 1% thanks to the fractional

reserve principle and within days, bank runs were commonplace

across the nation.

- Now Morgan stepped into the public

arena and offered to prop up the faltering American economy by

supporting failing banks with money he manufactured out of

nothing.

- It was an outrageous proposal, far worse than

even fractional banking, but Congress let him do it.

Hoarding money |

- Morgan manufactured $200 million worth of this

completely reserveless money and bought things with it, paid

for services with it, and sent some of it to his branch banks

to lend out with interest.

- His plan worked, and soon the

public regained confidence in money in general, and quit

hoarding their currency.

- But as a result, banking power

was further consolidated into the hands of a few large banks.

- By

1908, the panic was over and Morgan was hailed as a hero by

the president of Princeton University by a man named Woodrow

Wilson.

|

All this could be avoided if we appointed a

committee of 6 or 7 public-spirited men like J.P.

Morgan to handle the affairs of our country. (Woodrow

Wilson)

|

.jpg)

Harris & Ewing, photographer, Public domain, via Wikimedia Commons

Woodrow Wilson

- 28th president |

- During the 1912 Democrat Convention, William Jennings

Bryan was a powerful figure who helped Woodrow Wilson

(1856-1924) win the

nomination.

- It was

during Wilson's term that the Federal Reserve Act was

passed in 1913.

- When Wilson became president, he appointed

Bryan as Secretary of State.

- However, Bryan soon became

disenchanted with the Wilson administration and he served only

2 years before resigning in 1915 over the highly suspicious

sinking of the Lusitania.

- This was the event used to

drive America into World War I.

- Although William James

Bryan never gained the presidency, his efforts delayed the

money changers for 17 years from attaining their next goal, a

new privately owned central bank for America.

Panic of 1907 |

- Economic textbooks would later explain that creation of

the Federal Reserve was the direct result of the Panic of

1907.

- Quote, 'With its alarming epidemic of bank

failures, the country was fed up once and for all with the

anarchy of unstable banking.'

- Minnesota congressman,

Charles A. Lindbergh Sr., Republican, later explained that the

Panic of 1907 was really just a scam.

- Now can you see how

all these chumps line up for public offices and play both

sides?

- Since the passage of the National Bank Act of 1863,

the money changers have been able to create a series of booms

and busts.

- The purpose was not only to fleece the

American public of their property, but to later claim that the

banking system was basically so unstable that it had to be

consolidated into a central bank once again.

|

Those not favorable to the money trust could be

squeezed out of business and the people frightened

into demanding changes in the banking and currency

laws which the Money trust would frame. (Charles

A. Lindbergh)

|

Jekyll Island |

- After the crash, Teddy Roosevelt in response to the

Panic of 1907 signed into law a bill creating something called

the National Monetary Commission.

- The commission was to

study the banking problem and make recommendations to

Congress.

- Of course, the commission was packed with J.P.

Morgan's friends and cronies.

- The National Monetary Commission was a U.S. congressional commission created by the

Aldrich–Vreeland Act of 1908.

- The commission's reports and recommendations became one of the principal bases in the enactment of the Federal Reserve Act of 1913 which created the modern Federal Reserve system.

.jpg)

Public Domain via

Wikimedia Commons

Nelson W. Aldrich |

- The chairman was a man named Senator Nelson Aldrich from

Rhode Island and he represented the Newport homes in his state

owned by America's richest banking families.

- Aldrich's

daughter married John D. Rockefeller Jr., and together they

had 5 sons; John, Nelson, Lawrence, Winthrop and David, who

was the head of the Council on Foreign Relations and former

chairman of Chase Manhattan Bank, which later combined with

JPMorgan Chase & Co.

- Son Nelson Rockefeller (1908-1979)

was vice president to Republican Gerald Ford, the 38th

president, in 1974.

- As soon as the National Monetary

Commission was set up, Senator Aldrich immediately embarked on

a 2-year tour of Europe where he consulted at length with the

private central bankers in England, France and Germany.

-

The total cost of his trip alone to the taxpayers was $300,000

which was an astronomical sum in 1908.

|

J.P. Morgan as Nelson Aldrich |

|

|

John Pierpont Morgan

1837-1913

4/17

3/31

Banker |

Nelson Wilmarth Aldrich

1841-1915

11/6

4/16

Banker crony |

|

|

|

Crooks |

- Shortly after Aldrich returned from Europe, on November

22, 1910, some of the wealthiest men in America boarded his

private rail car, and in the strictest secrecy, journeyed to

Jekyll Island off

the coast of Georgia.

Public Doman via

Wikimedia Commons

Paul Moritz Warburg |

- With the group came Paul Warburg (1868-1932), a

German born American investment banker.

- Warburg had been

given a $500,000 per year salary to lobby for the passage of a

privately owned central bank in America by the investment

firm, Kuhn Loeb & Company.

- His partner in this bank

was a man named Jacob Schiff, the grandson of the man who

shared the 'Green Shield' house with the Rothschild family in

Frankfurt, Germany.

- Schiff was in the process of spending

$20 million to finance the overthrow of the Czar in Russia.

|

Kuhn, Loeb & Co., a major player in finance for decades, involved in massive deals like recapitalizing the Union Pacific Railway alongside figures like Jacob Schiff and James Stillman.

(Assistant)

|

|

J.P. Morgan as Paul Warburg |

|

|

John Pierpont Morgan

1837-1913

4/17

3/31

Banker |

Paul Moritz Warburg

1868-1932

8/10

1/24

German born banker |

|

|

|

Jekyll and hide |

- These 3 European banking families, the Rothschilds, the

Schiffs and the Warburgs were interconnected by marriage down

through the years, just as their American counterparts, the

Rockefellers, Morgans and Aldriches were.

- Secrecy was so

tight that all 7 primary participants were cautioned to use

only first names to prevent servants from learning their

identities.

Public Doman via

Wikimedia Commons

Frank A. Vanderlip |

- Years later, one participant, Frank A.Vanderlip

(1864-1937), president of National City Bank of New York and a

representative of the Rockefeller family, confirmed the Jekyll

Island trip in a February 9, 1925,

Saturday Evening Post article.

|

I was as secretive indeed, as furtive as any

conspirator... Discovery, we knew, simply must not

happen, or else all our time and effort would be

wasted. If it were to be exposed that our particular

group had got together and written a banking bill,

that bill would have no chance whatever of passage in

Congress. (Frank A.Vanderlip)

|

Banks slipping |

- The participants travelled to Jekyll Island to figure

out how to solve their major problem, how to bring back a

privately owned central bank.

- But there were other

problems that needed to be addressed as well.

- First of

all, the market share of the big national banks was shrinking

fast.

- In the first 10 years of the 20th-century, the

number of U.S. banks had more than doubled to over 20,000.

- By 1913, only 29% of all banks were national banks, and they

held only 57% of all deposits.

- As Senator Aldrich later

admitted in a magazine article, 'Before passage of this Act,

the New York bankers could only dominate the reserves of New

York, now we are able to dominate the bank reserves of the

entire country.'

Expansions |

- Therefore, something had to be done to bring these new

banks under their control.

- As John D. Rockefeller put it,

'Competition is sin.'

- Secondly, the nation's economy was

so strong that corporations were starting to finance their

expansions out of profits instead of taking out huge loans

from large banks.

- In the first 10 years of the

20th-century, 70% of corporate funding came from profits.

-

American industry was becoming independent of the money

changers and that trend had to be stopped.

- All the

participants knew that these problems could be hammered out

into a workable solution.

Hidden |

- But perhaps their biggest problem was a public relation

problem, the name of the new bank, a decision that took place

in a conference room in the sprawling Jekyll Island Club

Hotel.

- Aldrich believed that the word 'bank' should not

even appear in the name.

- Warburg wanted to call the

legislation the National Reserve bill or the Federal Reserve

bill.

- The idea here was to give the impression that the

purpose of the new central bank was to stop bank runs, but

also to conceal its monopoly character.

- However, it was

Aldrich, the egotistical politician, who insisted it be called

the Aldrich Plan which promoted the need to create a

private central bank.

Money out of

nothing |

- After 9 days at Jekyll Island, the group dispersed and

the new central bank would be very similar to the old Bank of

the United States.

- It would be granted a monopoly over

U.S. currency and create that money out of nothing.

- How

does the Fed create money out of nothing?

- It's a

four-step process, but first a word on bonds.

- Bonds are

simply promises to pay, or government IOUs.

- People buy

bonds to get a secure rate of interest because at the end of

the term of the bond, the government repays the bond plus

interest, and the bond is destroyed.

- There are about $38

trillion worth of these loans or bonds at present and that is

called the national debt.

Money making

process |

- Now here is the Fed money-making process.

- Step one,

the Federal Open Market Committee approves the purchase of

U.S. bonds on the open market.

- Step two, the bonds are

purchased by the Fed from whoever is offering them for sale on

the open market.

- Step three, the Fed pays for the bonds

with electronic credits to the seller's bank, which in turn

credits the seller's bank account and the trick is that these

credits are based on nothing, the Fed just creates them.

-

Step four, the banks use these deposits as reserves, they can

loan out over 10 times the amount of their reserves to new

borrowers, all at interest.

Thin air |

- In this way, a Fed purchase of say a $1 million worth of

bonds gets turned into over $10 million in bank accounts.

- The Fed in effect creates 10%

of this totally new money and the banks create the other 90%.

- To reduce the amount of money in the economy, the process is

just reversed.

- The Fed sells bonds to the public and the

money flows out of the purchaser's local bank.

- Loans must

be reduced by 10 times the amount of the sale.

- So, a

Fed's sale of $1 million in bonds results in $10 million less

money in the economy.

Jekyll bankers cast

in stone |

- How does this benefit the bankers whose representatives

huddled at Jekyll Island?

-

First, it totally misdirected banking reform efforts from

proper solution.

- Second, it prevented a proper debt-free

system of government finance like Lincoln's Greenbacks from

making a comeback.

- The bond-based system of government

finance forced on Lincoln was now cast in stone.

- Third,

it delegated to the bankers the right to create 90% of our

money supply based on only fractional reserves, which they

then loan out at interest.

- Fourth, it centralized overall

control of our nation's money supply in the hands of a few

men.

- Fifth, it established a centra bank with a high

degree of independence from effective political control.

Fooled the public |

- Soon after the banks creation, the Fed's great

contraction in the early 1930s would cause the Great

Depression.

- This independence has been enhanced since

then through additional laws.

- In order to fool the public

into believing the government retained control, the plan

called for the Fed to be run by a board of governors appointed

by the president and approved by Senate.

- But all the

bankers had to do was to be be sure their men got appointed to

this board.

- That wasn't hard because bankers have money

and money buys influence over politicians.

Endorse |

- Once the participants left Jekyll Island, the public

relations blitz was on.

- The big New York banks put together an

educational fund of $5 million to finance professors at

'respected' universities to endorse the new bank.

- Woodrow

Wilson at Princeton was one of the first to jump on the

bandwagon but banker's subtrifuge didn't work.

- The

Aldrich Plan bill was quickly identified as the banker's bill, a

bill to benefit only what became known as the money trust.

|

The Aldrich Plan is the Wall Street Plan. It means

another panic, if necessary, to intimidate the people.

Aldrich, paid by the government to represent the

people, proposes a plan for the trusts instead. (Charles

A. Lindbergh)

|

Public Doman via

Wikimedia Commons

Bernard Mannes

Baruch |

- Seeing that they didn't have the votes to win in

Congress, the Republican leadership never brought the bill to

a vote and the bankers quietly decided to move to track two,

the Democratic alternative.

- They began financing Woodrow

Wilson as the Democratic nominee.

- Wall Street financier,

Bernard Baruch (1870-1965) was put in charge of Wilson's

education.

|

Baruch brought Wilson to the Democratic Party

Headquarters in New York in 1912, leading him like one

would lead a poodle on a string. Wilson received an

indoctrination course, from the leaders convened

there. (James Perloff)

|

|

Frank Vanderlip as Bernard Baruch |

|

|

Frank Arthur Vanderlip

1864 - 1937

11/17

6/30

Banker |

Bernard Mannes Baruch

1870-1965

8/18

6/20

Wall Street financier |

|

|

|

Brainwasher |

- So now the stage was set and the money changers were

poised to install their privately owned central bank once

again.

- The damage that President Andrew Jackson had done

76 years earlier had been only partially repaired with the

passage of the National Bank Act during the Civil

War.

- Since then, the battle had raged on across the

decades.

- The Jacksonians became the Greenbackers who

became the hardcore supporters of William Jennings Bryan.

-

With Bryan leading the charge, these opponents of the money

changers, ignorant of Baruch's tutelage, now threw themselves

behind Democrat Woodrow Wilson, they and Bryan would soon

be betrayed.

Daily Iowa State

Press - January 21, 1901 |

|

If thou art rich, thou'rt poor;

For, like an ass whose back with ingots bows,

Thou bears thy heavy riches but a journey,

And death unloads thee.

Shakespeare,

Measure for Measure

|